How to Send Money to Brazil in 2023 – The Definitive Guide

Sending money to Brazil is way more complex than most foreign citizens expect. Brazil has a history of extreme regulation of money entering and leaving the country. Banks in Brazil face fines in the hundreds of thousands of reais if such wire transfers are not heavily scrutinized and documented. So, it is not a surprise that in case of doubt, Brazilian banks will always be overzealous.

You can also read this page in Portuguese. Don’t forget to check our FAQ section located at the end of this page.

What is the timeline for a bank wire transfer to be released in Brazil?

Brazilian banks may take several days or even weeks to release large amounts (e.g.: over R$200,000), requiring that the receiving party provide many documents and get registered with their currency exchange departments.

Is the government bureaucracy the only reason for the complexity?

No! Currency exchange departments in traditional Brazilian banks take a long time to review the documents and approve the transaction. There is also a substantial disconnection between the bank back-office and the branch personnel and the fact that most bank employees are not fluent in English, bringing more friction to the mix.

Why should I care? Isn’t sending a wire transfer my only obligation as a buyer?

Unfortunately not. Although it doesn’t take you more than 10 minutes to send a wire transfer from the USA, the transfer will not be of any good unless the recipient actually gets the money! It is not uncommon for Brazilian banks to return wire transfers to the USA after the recipient party fails to satisfy the bank’s requirements.

So, if I get the paperwork right, is the release of my wire transfer guaranteed?

No. It is never guaranteed. We can tell you that for the most straightforward and well-supported transactions, the recipient bank will almost always end up releasing the funds. The problem is that most transactions involving large sums are not interpreted as “straightforward” by the banks.

Transferring Large Sums to Brazil?

We Can Help You

Click Here for our Money Transfer Service for Large Sums

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us to get a free quote, or

#2 Schedule a Consultation now.

The Brazilian bank wants me to wire the funds to the seller instead of (my account / my wife’s account / my attorney’s account / etc.). Why Is That? Should I be concerned?

The Brazilian bank wants to be the most conservative possible. For instance, if you are buying a property, they think you should send the money to the seller – not someone else! The underlying concern is that you may pretend to purchase a property just to send a lot of money to Brazil at once.

Paying a seller directly may be concerning since you cannot time the release of the funds to match with the closing. This is the dilemma: the main banks in Brazil, such as Bradesco, Itau, and Banco do Brasil, will always push for large payments to be made directly to the selling party. But, this will destroy any leverage you have to make the seller attend the closing and transfer title to what you are buying.

What about an escrow account? Can’t I simply send my payment to the escrow holder?

No. Escrow accounts are not part of the culture in Brazil.

What about title insurance when buying a property? Can’t I simply send my payment to the title agency?

No. There is no title insurance in Brazil.

So, what can I do to avoid these issues?

First, educate yourself by learning how things work in Brazil. You should not assume that cross-border transactions work the same way they work in your country. Second, allow yourself a long time between signing the contract and the closing date. We recommend a period of 60 to 90 days. The more time you have, the higher the chances you will get your ducks in a row to successfully transfer the necessary funds while retaining the right conditions for a safe closing.

And, it is within this context that we explore the different ways to send money to Brazil, their pros, and their cons.

Three Ways to Transfer Money to Brazil

Learn the three main ways to send money to Brazil, their pros, and their cons.

1) Small Amounts – Web Platforms

If you are transferring small payments to family, friends, or even a small downpayment upon signing a property purchase contract, you may want to check how to transfer amounts of up to USD10,000 through apps to Brazil.

If you are transferring small payments to family, friends, or even a small downpayment upon signing a property purchase contract, you may want to check how to transfer amounts of up to USD10,000 through apps to Brazil.

2) Higher Amounts – Everyday Banks in Brazil

If you need to send an amount higher than USD10,000, traditional banks may work as long as you are willing to endure the severe red tape and friction involved. Make sure you have a solid documentation to support your transfer and that you are comfortable with the seller being fully paid before you get legal title to the property (or another asset) you are buying. Learn more on how to send money to Brazil through the usual bank system.

3) Large Amounts – Attorney along with a Currency Exchange Bank

Currency Exchange Banks in Brazil (not the same as currency exchange houses or exchange bureaus) represent a better alternative than traditional banks. Currency Exchange Banks work well when paired with an attorney or law firm proficient in cross-border transactions. Learn how Currency Exchange Banks are the ideal path to send large sums to Brazil.

Transferring Large Sums to Brazil?

We Can Help You

Click Here for our Money Transfer Service for Large Sums

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us to get a free quote, or

#2 Schedule a Consultation now.

More about Transferring Money to Brazil

4) The Seven Things You Must Know about Money Transfers to Brazil

By just learning these seven things you need to know when transferring money to Brazil, you will be better prepared than the vast majority of people trying to send money to Brazil! Check it now.

By just learning these seven things you need to know when transferring money to Brazil, you will be better prepared than the vast majority of people trying to send money to Brazil! Check it now.

5) The Definitive FAQ about Sending Money to Brazil

Have a very specific question about international money transfer to Brazil? Check our definitive FAQ to read all questions and answers ever received by our staff. Got a question not addressed? Ask this question on our YouTube page to have it answered at no cost to you and added to our FAQ.

6) Watch our Video Sending Money to Brazil to Buy Real Estate

Are you in a hurry and got only 3 minutes to spare? Want to know some of the main things to know when transferring money to Brazil to purchase Real Estate. Watch our Sending Money to Brazil to Buy Real Estate video now!

7) Read our other Real Estate in Brazil guides

Are you in a hurry and got only 3 minutes to spare? Want to know some of the main things to know when transferring money to Brazil to purchase Real Estate. Watch our Sending Money to Brazil to Buy Real Estate video now!

*** IMPORTANT ***

This content is intended for general information purposes only and does not constitute legal advice.

For legal issues or decisions of any kind, the reader should retain and consult legal counsel. You should not act or rely on the information on this website without first seeking the advice of an attorney. The determination of whether you need legal services and your choice of a lawyer are very important matters that should not be based on websites or advertisements.

1) Transferring Small Amounts to Brazil – Web Platforms

Until not long ago, the so-called apps were not authorized to work in Brazil. The Bolsonaro administration gradually and substantially reduced the barriers for such apps to operate in Brazil as well as red tape across the administration’s departments.

1.1) Western Union – Physical stores in Brazil. Cap usually at R$10,000 (reais!)

Today Western Union operates in most main Brazilian cities. While you can send money to Brazil by depositing in a western union store in your country of residency for the Brazilian counterparty to withdraw the funds in Brazil, most remittances are capped at really low amounts. Most stores will cap the remittance to R$10.000,00 while others will have even lower caps.

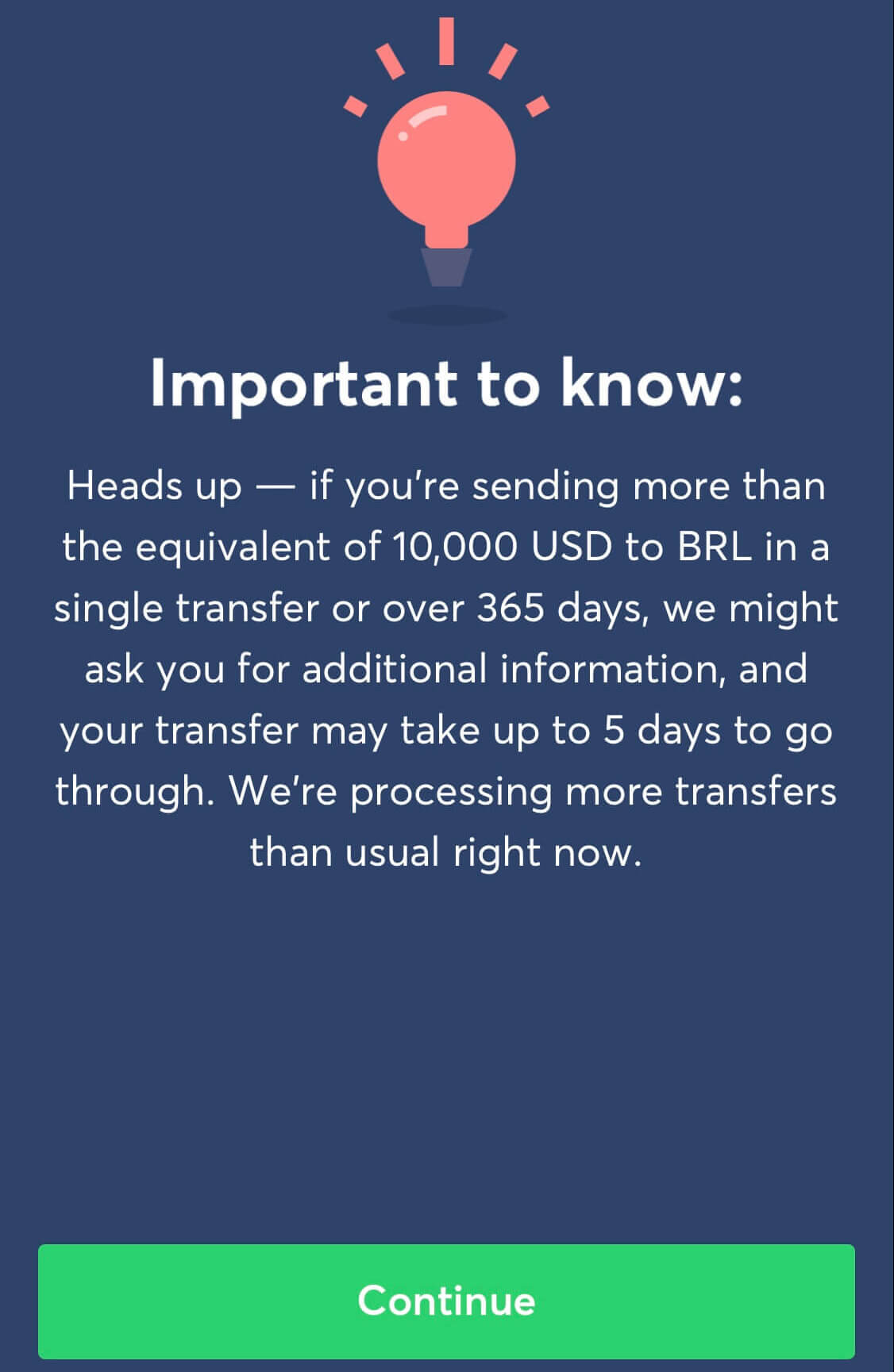

1.2) Wise (former TransferWise) – Digital operation only. Cap usually at $10,000 (US dollars!)

Wise is currently considered the easiest way to send money to Brazil. While it is not clear how much Wise operations have been vetted by the Brazilian authorities, we are aware of a large number of foreign individuals successfully sending money to Brazil through Wise.

Just like Western Union, Wise is also limited to lower amounts when operating through her app. However, it looks like Wise may allow larger amounts to be sent to Brazil when dealing with their back-office (information not confirmed).

Warning: the fact that you have transferred funds to Brazil successfully through Wise in the past does not mean you will continue to be able to do so. Many of our clients have reported increased document requirements over time (e.g., copies of passport, source of funds, etc.) and even plain refusal of the company in allowing additional transfers.

Copy of an actual warning from Wise.

Being aware of such risks is important so you don’t end up learning you cannot send more money right before a payment deadline is up.

1.3) Paypal

Paypal has two main modalities for money remittance: (a) purchase of sales or goods and (b) family and friends.

We do not recommend using Paypal for remitting money to a party in Brazil. We have personally experienced issues related to Paypal arbitrarily withholding funds. The last thing you want to happen when sending money to honor a contract is Paypal sitting on your money while the seller gets mad at you and you face the risk of severe contractual penalties being triggered.

1.4) Monito

Monito has an interesting business model. Instead of actually processing the remittances, they ask you some basic info about your remittance and then show how the actual processors would handle the transaction along with associated fees. Among Monito’s partner processors are Wise, MoneyGram, and others.

1.5) Other Processors

Depending on where you are sending the funds from, you may want to check other money remittance processors such as MoneyGram, small world, WorldRemit, Skrill, Paysend, and Remitly.

Important: we do not endorse any of these services here described. It is up to you to select and investigate the trustworthiness of the money remittance processor. Use money remittance processors at your own peril.

*** IMPORTANT ***

This content is intended for general information purposes only and does not constitute legal advice.

For legal issues or decisions of any kind, the reader should retain and consult legal counsel. You should not act or rely on the information on this website without first seeking the advice of an attorney. The determination of whether you need legal services and your choice of a lawyer are very important matters that should not be based on websites or advertisements.

[back to top]

2) Transferring Larger Amounts to Brazil – Everyday Bank System

In this section, we discuss the user of traditional banks in Brazil when transferring money from abroad.

How to Pick Banks in Brazil

Traditional banks in Brazil, such as Bradesco, Itau, and Banco do Brasil, usually take several days to process a wire transfer from abroad. It is not uncommon for people to wait weeks until the funds are released.

Banks specializing in currency exchange are usually much faster. They can review documents quicker and get a wire transfer released in just a few days.

The situation may be even worse in smaller towns

When a party tries to receive a wire transfer in smaller Brazilian towns or branches in the suburbs, the chances of trouble increase even more since local branches have little to zero experience with international wire transfers.

Examples of transactions prone to be declined by traditional Brazilian banks:

- you want yourself or another person to receive the funds on your behalf to pay the seller at closing;

- your source of income comes from a business instead of employment;

- a parent or a relative will be paying part or all of the cost.

In terms of how to send money when buying real estate in Brazil, there are two main approaches:

- Send the money directly to the seller

Sending the payment directly by bank transfer (e.g.: from your Chase, Bank of America, etc.) to the seller may be the preferred approach for sending a smaller downpayment (e.g., no more than 10% of the total purchase price).

Downside – Risk of Paying Seller Before Closing

We don’t like to see our clients paying large amounts to the seller by bank transfer previous to closing. Sending a full payment to sellers before the closing will put you in a very fragile position since a seller may not necessarily attend the closing later on (e.g., seller dies between payment and closing date, seller change his mind about selling, or seller intends to defraud the buyer).

Upside – Let the Seller Do the Leg Work

The biggest upside of sending monies directly to a real estate seller is that this person is highly motivated to be paid. As long as you give the seller a clear and conspicuous heads up about the fact that their bank will ask them for lots of documents and require a lot of communication, the seller will be the one bearing the burden of making the bank release the funds.

- Use power of attorney to have a lawyer or a local trust party deliver payment by check at closing

Through a power of attorney (POA), you can have a lawyer or a family member representing you at the closing. A valid POA allows you to transfer the closing funds to the POA holder instead of the seller.

The POA holder can then use your funds to obtain a certified check at his bank and use this certified check to pay the seller during the closing. The advantage of this approach is that the seller will not get your money until the moment that they sign the transfer of title.

Downside – Can You Trust Your POA?

Sending your money to someone in Brazil involves substantial risk. Is this person reliable? What if this person ends up kidnapped because of the money?

If buying a property in Brazil

You would then issue a certified check with the funds from your Brazilian bank to attend the closing in person. Your check should be handed to the seller only after the seller signs the transfer of title at closing. The downsides of this approach for parties living outside of Brazil would be the multiple trips required to Brazil (open the bank account, attend the closing, etc.)

*** IMPORTANT ***

This content is intended for general information purposes only and does not constitute legal advice.

For legal issues or decisions of any kind, the reader should retain and consult legal counsel. You should not act or rely on the information on this website without first seeking the advice of an attorney. The determination of whether you need legal services and your choice of a lawyer are very important matters that should not be based on websites or advertisements.

[back to top]

3) Transferring Large Amounts to Brazil – Currency Exchange Banks

Using currency exchange-specializing banks is always our #1 recommendation for clients purchasing real estate in Brazil. Read more to know why.

You need a legitimate reason to send large amounts of money to someone in Brazil. The legitimacy of such transactions is closely evaluated by Brazilian banks from a technical perspective. The two main factors involved in such analysis are:

(a) Declared Income and

(b) Purpose of the transfer.

Most of our clients need to send a large amount of money when buying real estate properties in Brazil. For this purpose, banks will focus their analysis on:

(a) deciding if your declared income is compatible with the price of the property you are buying and

(b) if there is a certainty that you are buying the property.

It is common for our clients to say, “the red tape involved in getting a transfer of money to Brazil is unbearable.” Many of our clients decide to hire us after missing the closing date, incurring substantial penalties (e.g., 10% of the contract amount), and being threatened to be sued by the seller.

We Can Help

If you need professional help getting a transfer to Brazil, contact us today. To get your specific questions answered by our attorneys, please schedule a paid consultation here.

Currency Exchange Banks

3.1) How are Currency Exchange Banks different from Everyday Banks in Brazil?

Everyday banks in Brazil are banks such as Bradesco, Itau, and Banco do Brasil. Most of them have branches. Newcomers as Nubank and Banco Inter do not have branches, but they are also focused on traditional banking operations. Such banks have currency exchange departments in their back-offices that are not closely integrated with their branches or customer service channels.

There is a lot of disconnection and friction when you use such banks. As their experience with currency exchange is also limited, they limit their money transfer services to transactions that fit neatly in what they see as straightforward transactions. Any international money transfer that goes beyond the basic will not be welcome by these banks.

Currency exchange banks in Brazil will usually stay away from traditional banking operations and focus their resources on currency exchange and a few other specialized types of transaction.

In addition to knowing what they are doing, currency exchange banks in Brazil will offer better exchange rates and overall smaller transfer fees.

3.2) Can I simply hire the services of a Currency Exchange Bank and be worry-free?

The main downside of using such banks is that they are not usually willing to work with consumers.

They will rather work with a more sophisticated party who will not waste their time with transactions that end up not materializing or require every step of the process to be explained.

3.3) Which are the circumstances when a payor must seek a currency exchange bank?

The three main reasons to use currency exchange banks instead of major banks in Brazil:

1) Seller is unwilling or incapable of handling the legwork required to release funds through their own bank;

2) Your source of income is unconventional and everyday banks will not accept it;

3) your tax returns do not support a level of income required to purchase the property as per everyday bank standards;

Additionally, currency exchange banks customarily offer better exchange rates and smaller transfer fees. The explanation is that currency exchange banks specialize in one or two types of services instead of many financial services.

3.4) Can I work directly with the currency exchange bank? Or, do I have to hire you as my attorney?

Now, even when working with a currency exchange bank, you would still have to decide to work with this bank “solo” or hire an attorney like us to intermediate the transaction.

Large remittances to Brazil are highly scrutinized and no legitimate bank or financial institution in Brazil will allow them without a substantial amount of paperwork and red tape. Do not rely on individuals, intermediaries, or small agencies abroad as they may be operating off books. If someone takes your money and does not credit you in Brazil, you may be out of luck for good.

Sophisticated Recipients

Professional sellers of luxury real estate in Brazil are usually the parties best prepared to interact with their bankers and enable such remittances to be received through a regular commercial bank such as Itau, Bradesco, Banco do Brasil, or Santander.

All Other Recipients

Most of the other sellers, whether middle-class citizens or even private wealthy sellers of real estate in Brazil have no clue about the red tape involved in receiving substantial sums of money from abroad.

Because of such lack of experience, and the optimistic nature of Brazilians, such sellers will usually get into a sale transaction with a foreign buyer without understanding the complexity of such transaction. It is not a surprise that many of these transactions will end up in trouble.

Sellers will get annoyed when they do not get their money on time, buyers will get spooked when their money gets entangled between the sender and the receiver bank, and attorneys may need to get involved when it is unclear if penalty clauses addressing late payment will be applicable or not.

We Can Help

If you need professional help getting a transfer to Brazil, contact us today. To get your specific questions answered by our attorneys, please schedule a paid consultation here.

*** IMPORTANT ***

This content is intended for general information purposes only and does not constitute legal advice.

For legal issues or decisions of any kind, the reader should retain and consult legal counsel. You should not act or rely on the information on this website without first seeking the advice of an attorney. The determination of whether you need legal services and your choice of a lawyer are very important matters that should not be based on websites or advertisements.

Transferring Large Sums to Brazil?

We Can Help You

Click Here for our Money Transfer Service for Large Sums

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us to get a free quote, or

#2 Schedule a Consultation now.

[back to top]

4) The Seven Things You Must Know about Money Transfers to Brazil

So, now you know that sending large amounts of money to Brazil will almost inevitably result in some level of headache. What can you do to reduce the friction of such transactions? Tips to reduce friction and headache:

- Provision in the contract a longer period for remittance of downpayment and closing payment. We recommend at least 60 to 90 days for closing after the contract signature.

- Direct sellers to discuss with their bank account manager all the required documents and steps to receive the monies sent from abroad. This will assure the seller is aware of the timeline and also get the documents required prepared without delays.

- Pay attention to how a purchase and sale agreement allocates the penalty in case of payment delays. Ideally, the buyer would have some wiggle room detailed in the contract to cover cases of delays caused by the complexities involved in the money transfer.

- Consider working with a Brazilian bank specializing in currency exchange, which is usually faster in handling large money remittances to Brazil.

- Factor in how friendly and willing to work through potential hiccups the seller is. A seller easy to work with may offset part of the red tape and challenges of remitting large amounts of money to Brazil.

- Avoid schemes designed to avoid the Brazilian regulations. Relying on non-registered financial providers and individuals engaged in dollar-cabo may result in a complete loss of your monies in addition to civil penalties and criminal prosecution.

- Hire an attorney specializing in cross-border real estate transactions to assist you with your purchase.

*** IMPORTANT ***

This content is intended for general information purposes only and does not constitute legal advice.

For legal issues or decisions of any kind, the reader should retain and consult legal counsel. You should not act or rely on the information on this website without first seeking the advice of an attorney. The determination of whether you need legal services and your choice of a lawyer are very important matters that should not be based on websites or advertisements.

[back to top]

5) The Definitive FAQ about Sending Money to Brazil

- What is the best way to send money to Brazil?

For smaller amounts, sending money through the apps/digital platforms make sense. For larger amounts (e.g., the total required for a real estate purchase), a traditional wire transfer is the way to go.

From an accounting and tax authority perspective, any monies entering the country must be declared by the receiving party. Because of such requirements, the use of regular wire transfers with the support of an accountant to properly file your tax return in Brazil will bring maximum peace of mind.

- Can’t I simply stuff USD100,000 in my case and fly to Brazil with cash?

NO, YOU CAN NOT. First, you need to declare to the Brazilian Federal Police any amounts higher than R$10,000 (roughly USD2,000). If you don’t declare and they find the cash, the cash will be seized, and you will have to wait months to retrieve it (considering you are able to prove it came from a legitimate source of income) and spend big money with attorneys.

What about if I declare the money before arriving in Brazil? See the next question.

- Can I take USD100,000 in cash to Brazil as long as I follow the Brazilian Customs requirement of previously declaring the cash possession?

NOT A GOOD IDEA. There is an assumption worldwide that good people don’t carry hundreds of thousands of dollars in cash. Sorry to break the news, but carrying bags of cash is done mostly by smugglers, drug traffickers, thieves, and other types unable to move money through legitimate channels.

So, even if you properly declare to the Brazilian Customers / Brazilian Federal Police that you are carrying this amount of cash, there is a substantial chance that your cash will still be seized until you can convince the authorities that your money is clean.

- How do I send money to someone in Brazil?

To send little money, consider apps such as Western Union and Wise. To send more money, you will need to send through a regular wire transfer not forgetting that the recipient party will need to show documents, contracts, and proof of destination for the monies sent by wire transfer.

- How to send little money to Brazil from the USA

Western Union and Wise work are some of the money transfer services available in Brazil. Such money transmitters work well for US-based parties sending little amounts. Through these services, you can have a money transfer directly to the recipient account or available as cash pickup in Brazil.

To send more money (e.g.: over $10,000) it is not possible to send money online. You will need to send through a regular wire transfer not forgetting that the recipient party will need to show documents, contracts, and proof of destination for the monies sent by wire transfer.

- Can’t I just open a bank account in Brazil in my name and then wire transfer funds from my account in the US to my account in Brazil?

By opening a bank account in Brazil you may be able to transfer your funds from abroad to your bank account in Brazil. Most banks will still require you to send money through a traditional wire transfer, meaning you are still required to present documents to release the money in Brazil.

Additionally, while some banks in Brazil are starting to allow bank accounts to be opened remotely, this does not apply to foreign citizens who do not have at least a national Brazilian ID known as the “Carteira de Registro Nacional Migratório” (National Migration ID Card). This ID is issued only to foreign citizens with the intention to migrate to Brazil.

- Can I take money with me to Brazil?

Travelers to Brazil can bring up to R$10.000 in cash without any formalities. For amounts over R$10.000, it is necessary that the person completes an e-DVB notice previous to arriving in Brazil.

Although the Brazilian revenue does not address what would happen if someone was bringing a large amount of cash (e.g., USD100,000), we assume that the carrier could be temporarily stopped by the police to assess the origin and purpose of such money.

In addition to the above inconvenience, there is also the risk of the cash being stolen.

Therefore, we highly recommend that travelers to Brazil not carry significant amounts of cash on them.

- What is the cheapest way to send money to Brazil?

We advise you not to have cost as the main driver of your decision on how to transfer money to Brazil. All the banks involved in transferring monies to Brazil must follow stringent rules related to how to analyze and document the remittances. These procedures cost money and such cost is naturally factored into the conversion exchange to be applied to your transaction.

Unnaturally highly favorable exchange rates are usually offered only by non-legit parties such as non-registered intermediaries and individuals or small entities doing the so-called “dolar-cabo”. Dolar cabo happens when two parties agree to release funds in different currencies in different countries without actually moving any funds. This is considered a crime in Brazil and most countries.

- An individual in Brazil offered to “exchange currencies with me”. He already has Brazil Reais available in Brazil and he will take my US Dollars in the US at a great exchange rate. Is this a good idea?

No. It is a terrible idea and it is also a crime. In addition, to becoming involved in a criminal activity, you would also risk losing all your money since the individual may be a scammer who has no intentions to give you any Brazilian reais after you give him access to your US Dollars.

- How much money can I send to Brazil?

There is no pre-fixed limit on how much money you can send to Brazil. Banks will review remittances on a case by case basis. Main factors considered are your declared income in your country of origin and how well you can prove to the bank that the underlying transaction is legitimate.

It is the illegal practice of trading dollars in the gray market for deposit in an institution abroad. This may or may not involve actual cross-border transfers of money. The practice is a crime under article 22 of the Brazilian Law concerning crimes against the Financial System. It is often used in money laundering schemes.

- Can I send my payment in trenches to Brazil to make the transfer easier?

No, you cannot. Sending money on a piece-meal basis to avoid detection or compliance by Brazilian banks is considered a crime in Brazil and many other countries. There is even a term for that: smurfing. Smurfing is a money-laundering technique involving the structuring of large amounts of cash into multiple small transactions. Smurfs often spread these small transactions over many different accounts, to keep them under regulatory reporting limits and avoid detection.

- Is it possible to buy a property in Brazil with cryptocurrency included in the contract?

Brazil is still working on a legal framework for cryptocurrencies.

Although not necessarily the same thing, it has been decided by some Brazilian courts that property purchase contracts may indicate an amount in US dollars as long as the actual transaction is liquidated in Brazilian reais.

In any scenario, we strongly recommend that parties in a real estate contract avoid indicating currencies other than Brazilian reais since the Brazilian legislation at the time of this writing disfavors such contracts and will actually hold many of them unenforceable.

Brazil is still working on a legal framework for cryptocurrencies.

- How to send money anonymously?

We do not recommend any unofficial ways to send money to Brazil either through your name or anonymously. When sending money to Brazil, your number one concern should be safety and certainty that your money will arrive at the right beneficiary. Concerns about getting the best currency rage for the US dollar or other currencies should be secondary.

- What are the US laws on sending money abroad?

We specialize in Brazil law, so we are not the right source to advise you on US laws. For this purpose, we recommend that you consult with a licensed US dollar to check on the US laws on sending money abroad.

- So with the “RNE card” Am I able to open a bank account? What about the “CPF” or is that only if I become a citizen of Brazil?

Yes, with the RNE card and the CPF you can open a bank account. CPFs are provided to any foreign citizens acquiring properties in Brazil. You do not need to become a citizen first. Remember that the RNE cards (Brazilian IDs for foreign citizens) will be given only to those with migrant intent and a respective application.

- What is the best way to go about getting a loan to buy property in Brazil

Loans in Brazil are more difficult to obtain than in countries such as the US. Although not impossible, financial entities in Brazil will almost never extend loans to foreign buyers.

Financial entities in Brazil will require a solid credit history in addition to sources of income verifiable in Brazil (meaning they will almost always ignore your income outside of Brazil).

A US lender would rarely accept collateral in Brazil. However, if you are able to secure a loan in the US based on other collateral (e.g., a home you own in the US), yes, you should be able to use the funds to purchase real estate in Brazil.

- All in all lots of bureaucracy. How can people still have the desire to invest in real estate in Brazil?

Yes, many people feel the same. The current Brazil administration is working toward reducing the bureaucracy, but we don’t see that happening any time soon. The truth is that Brazil is a unique country. People who really appreciate the country and the culture will find a way to go through all the hoops to own property in Brazil. And, do not forget. We offer a service where we take care of every single aspect of the property purchase process so you can just sit back and relax. The fee for this all-inclusive service is usually 5% of the property amount with a minimum amount applicable.

- What are the documents customarily asked by Banks to release a wire transfer sent to Brazil?

A sample list of documents, which may vary depending on the bank.

- Executed contracts showing the purpose of the payment

- Proof of downpayment

- Tax returns for the transferor (to show the source of funds) and the recipient (to show taxes are up to date)

- Copies of bank statements and paystubs to document sources of income

- Other documents such as IDs, Tax Cards, and proof of address for all parties

- Got a question now previously asked?

Please ask your question as a comment on this youtube video. Questions posted there are answered quickly and then posted here as well.

*** IMPORTANT ***

This content is intended for general information purposes only and does not constitute legal advice.

For legal issues or decisions of any kind, the reader should retain and consult legal counsel. You should not act or rely on the information on this website without first seeking the advice of an attorney. The determination of whether you need legal services and your choice of a lawyer are very important matters that should not be based on websites or advertisements.

Transferring Large Sums to Brazil?

We Can Help You

Click Here for our Money Transfer Service for Large Sums

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us to get a free quote, or

#2 Schedule a Consultation now.

6) Watch our Video About Sending Money to Brazil to Buy Real Estate

Watch our 3-minute video to know the basics about transferring money to Brazil by clicking here.

And, don’t forget to access and bookmark our complete Buying Real Estate Properties in Brazil YouTube playlist.

*** IMPORTANT ***

This content is intended for general information purposes only and does not constitute legal advice.

For legal issues or decisions of any kind, the reader should retain and consult legal counsel. You should not act or rely on the information on this website without first seeking the advice of an attorney. The determination of whether you need legal services and your choice of a lawyer are very important matters that should not be based on websites or advertisements.

[back to top]

7) Become a Pro in Brazil Real Estate by checking our other guides!

To learn all about purchasing real estate in Brazil, check our How to Buy Properties in Brazil guide.

You can also learn about the advantages of buying real estate in Brazil in our Why Buying Real Estate in Brazil guide. Find opportunities and decide where to buy using our Know Where to Buy Real Estate in Brazil guide.

*** IMPORTANT ***

This content is intended for general information purposes only and does not constitute legal advice.

For legal issues or decisions of any kind, the reader should retain and consult legal counsel. You should not act or rely on the information on this website without first seeking the advice of an attorney. The determination of whether you need legal services and your choice of a lawyer are very important matters that should not be based on websites or advertisements.

[back to top]

Transferring Large Sums to Brazil?

We Can Help You

Click Here for our Money Transfer Service for Large Sums

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us to get a free quote, or

#2 Schedule a Consultation now.