CPF Brazil

What is the CPF Number?

A CPF number is the Tax ID issued once you have been registered with the Brazilian Revenue. CPF stands for “Cadastro de Pessoas Físicas” (CPF meaning in English: Natural Persons Registry). The CPF has 11 digits, and it may be issued by the Brazilian revenue service in Brazil or Brazilian consulates and embassies abroad.

A CPF is required not only to purchase real estate in Brazil but many other things, such as paying your taxes, opening a bank account in Brazil, starting a company in Brazil, getting utility services, purchasing online, and being able to enter in contracts drafted in Brazil.

How to Get a Brazil CPF as a Foreigner

A CPF Id number is issued to both Brazilian citizens and foreigners. Most Brazilians get their CPF number in Brazil. Foreign citizens, however, may obtain a CPF at a Brazilian consulate or embassy, in certain public entities while visiting Brazil, or through an Attorney.

A CPF is a must for foreigners wanting to buy properties or live in Brazil. Getting a CPF will allow a foreign citizen to have access to many conveniences. The CPF, as a tax ID, is also used as your main identification when filing tax returns in Brazil. Note that having a CPF alone will not imply in becoming a tax resident in Brazil. Tax residency in Brazil is triggered by other factors, such as how long you are staying in the country and whether you are getting some substantial income (e.g., from renting your vacation home). Support from an accountant is required to assess your specific tax status. And, if you decide to stop doing business and living in Brazil, you may file a “final tax return” informing the Brazilian Tax Revenue that you will no longer be a tax resident.

Practical tip: buying a property in Brazil from a seller that has not asked for your CPF number? This may be a sign of fraud! Do not proceed with the transaction, as you must have a CPF to acquire real estate in Brazil legally.

Path 1: How to Get a Brazil CPF in 2023 (by Email. NO LONGER WORKING!!!!!!)

* UNFORTUNATELY, THE BRAZIL GOVERNMENT HAS REVOKED THE EMAIL ROUTE SINCE OCTOBER OF 2023. AS OF NOW, FOREIGN CITIZENS HAVE TWO OPTIONS TO OBTAIN A CPF:

A – APPLY FOR A CPF THROUGH A BRAZILIAN CONSULATE OR EMBASSY IN YOUR COUNTRY OF RESIDENCY; OR

B – APPLY FOR A CPF WHILE IN BRAZIL AT A BRAZILIAN REVENUE SERVICE IN PERSON (BANKS AND POSTAL SERVICES MAY ALSO ISSUE, BUT THEY ARE POORLY PREPARED TO INTERACT WITH FOREIGN CITIZENS IN OUR EXPERIENCE) *

Many Brazilian consulates and embassies stopped issuing the CPF after Covid. They are now directing foreign citizens to apply directly with the Brazilian treasury by email. We don’t know if this easy-to-apply channel will remain available in the long run. However, as of March of 2023, foreigners are able to apply for the CPF using the following email address: [email protected]. Exact step-by-step as follows:

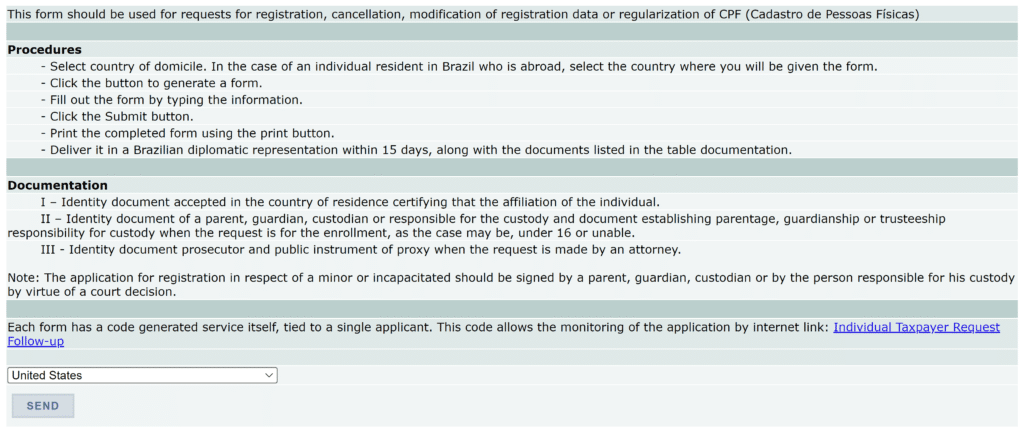

(1) fill out the form available at

https://servicos.receita.fazenda.gov.br/Servicos/CPF/cpfEstrangeiro/Fcpf.asp

Once you access the link you will see the following:

You should get help from a Portuguese-speaker since the English version of the form is no longer available to help you apply for the CPF. You should have a complete understanding of the instructions and requirements. A CPF is a full-fledged tax ID, and you don’t want to take this application lightly.

Select the Country

Here you will select your country of residence (not where you were born).

Once you have chosen correctly, click on “Send” and you will be redirected to the next step, which is generating you CPF Tax ID application form.

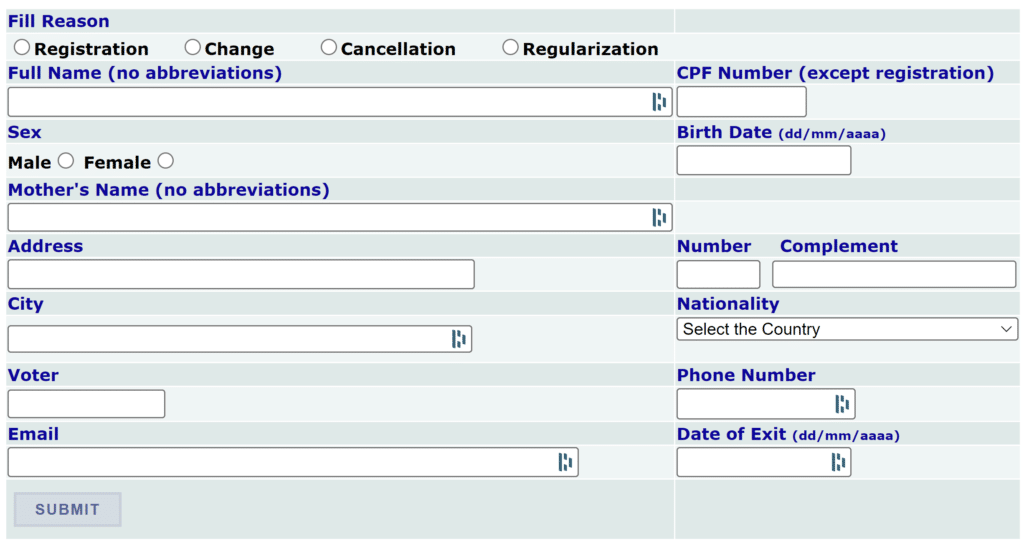

(2) Actual Form Screen

Read the procedures carefully and choose the country where you live. It is not necessary to indicate your country of birth at this point.

Once you have chosen correctly, click on “ficha” and you will be redirected to the next step, which is generating your CPF Tax ID application form.

The “Fill Reason” (“Motivo Preenchimento” for the Portuguese version) should be “Registration” (“Inscrição”). The other fields address personal information you should provide. Note that your date of birth should be provided in the following format: DD/MM/YYYY.

The following information is optional or not required:

- Electoral Title

- Country departure date

Once you finish entering information, click on “Submit” to move to the next step.

Important: make sure you authorize “pop-up” for the ready-for-print form to be made available!

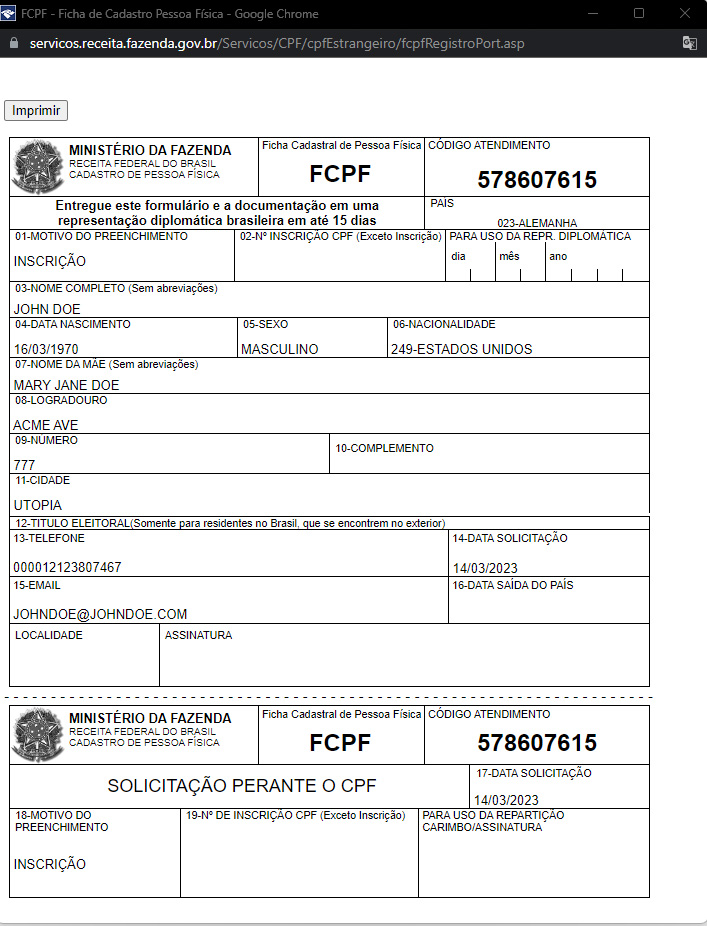

(3) Print out the form

That’s how the form should look like:

Your application form will be issued digitally, and it will be already filled with some of the information you submitted in the previous step.

(4) Sign the form

You need to sign the form under “Assinatura” and enter the city where you are under “Localidade”. Then, scan the form.

(5) Take a clear picture of your passport

You need a clear picture or scanned copy of your passport.

Make sure everything is readable and your face is also showing clearly. Some passports have a plastic layer on top of the paper that may cause issues when a flash or bright light is used when taking a picture.

(6) Take a self of yourself holding your passport

Use this example below as a guideline of how your picture should look like:

(7) Write an email to the Brazil Revenue Service

Write an email to [email protected] including:

a) “Inscrição de CPF” in the subject

b) “Inscrição de CPF” in the body

c) Attaching the complete signed form, a picture of your passport, and your selfie.

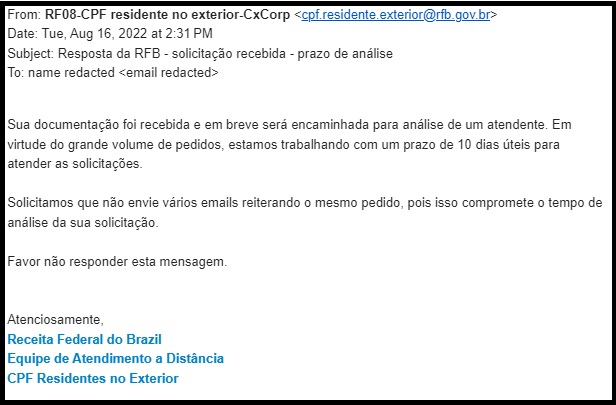

Congratulations!

Once you send the email, you will receive the confirmation shown below:

Feeling Grateful for this Guide? Share It With Others!

Did you enjoy our guide? Was it helpful to you? Great! Pass the information around so other people like you can have access to it. Member of an expat group? Share it there. Editor on Wikipedia? Share it there. Know a friend or a friend of a friend going to Brazil? Let them know the URL by using the sharing button below!:

Applying for the CPF to try out living in Brazil? Consider the Brazil Digital Nomad Visa the best and easiest way to stay legally in the country for up to two years!

Path 2: How to Get a CPF Outside of Brazil (in Person)

Getting a CPF number at Consulate or an Embassy

First, check if there is a Brazilian consulate or embassy close to your location. Once you click on a country’s name, click to the right on Brazilian Representations to see the available consulates or embassies in your country.

Second, go to the website of the consulate or embassy and see if they allow you to book an appointment. Their website will have an English version of the text, so you will be able to find the CPF Application section and, if available, book a day and time for you to attend the appointment. Turnaround for issuing the CPF is usually just a few days when the service is available.

You must complete the CPF application form available at the Brazilian Revenue. Print out a couple of copies, sign, date, and take them with you to your scheduled appointment.

Note that consulates and embassies don’t carry the plastic card to print your CPF number on, so you will get just the number instead (you do not need any certificate to use it since it is verifiable online)

Path 3: How to Get a CPF in Brazil (in Person)

If you are currently present in Brazil, you may go to one of these entities to apply in person for a CPF:

- Banks Banco do Brasil or Caixa Economica Federal

- Post Office Correios

- Brazilian Revenue Service

You should take the following documents with you when applying:

- A completed CPF form – unfortunately, this form is available in Portuguese despite being exclusive for foreigners, so you need to have help from a Portuguese speaker when completing it

- Proof of ID – a passport would be the original choice

Path 4: How to Get a CPF through an Attorney

For many people, going to a Brazilian consulate or embassy is not convenient. Additionally, because of the language and time constraints, applying directly with the Brazilian Revenue by email may not be ideal. For such clients, our firm offers a service handling the complete CPF number application.

In this case, you just have to provide the required documents listed below so we can prepare your application and file it on your behalf. No need to spend hours learning how a CPF number works, no need to travel, and no need to deal with trial and error and long waiting times. Most of our applications are approved in 10 calendar days, and our service is 100% guaranteed.

Copies of documents needed for us to apply on your behalf (simple copies by email are fine):

- Birth Certificate

- Passport

- Proof of address

As well as the following information:

- Marital status

- Occupation

- Phone number

Contact us now to place your order:

Need a CPF in Brazil?

We Can Help

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us to get a free quote, or

#2 Schedule a Consultation now

Brazilian CPF Crash Course (3-Minute Video)

Watch Our Video “How to Obtain the Brazilian Tax ID Known as CPF”. If you still have questions after watching our video, enter your questions in the comments area of our video. Questions entered as a comment will be answered by our licensed Brazilian attorneys. Check the comment section to have it answered by one of our licensed Brazilian attorneys

Questions entered as a comment will be answered by our licensed Brazilian attorneys. Check our YouTube channel for other videos addressing the purchase of real estate properties in Brazil

CPF F.A.Q.

A CPF number is the Tax ID issued when you register with the Brazilian Revenue. CPF stands for “Cadastro de Pessoas Físicas” (Natural Persons Register). The CPF has 11 digits, and it may be issued by the Brazilian Revenue Service in Brazil or Brazilian consulates and embassies abroad.

Yes, CPF numbers are required no matter if you are Brazilian or a foreign citizen for many things.

No, you don’t need one. CPF physical cards are issued only within Brazil. CPF numbers issued by Brazilian consulates or the Brazilian Revenue Service remotely come as a paper printout or PDF.

CPF Stands for “Cadastro de Pessoas Físicas” or “Registry of Individuals”. It is similar to the “Social Security” number adopted in the US, and it is used as a type of universal identifier in Brazil. While the RG (General Registration Number) is a Brazilian ID issued at the state level and, as such, can have duplicity of numbers, the CPF is unique and is issued by the Federal Government.

Some of the CPF purposes described by the Brazilian Revenue Service include: paying taxes in Brazil, being a legal representative of another, entering real transactions, getting a bank account of any type, investing in the country, owning vehicles, boats, or airplanes, owning companies, being a financial dependent of another.

No. In addition to a CPF, you will need a Brazilian ID and proof of address. The Brazil Federal Police issues the CRNM (National Migration Registration Card) exclusively for foreign citizens.

Not necessarily. The Brazilian Revenue does not automatically require you to file a tax return in Brazil just because you got a CPF. Instead, you will be required to file a tax return when you have substantial income in the country, among other situations, no matter if you have a CPF or not.

CPF numbers are more frequently shared in Brazil than social numbers are in the US. CPF numbers are actually printed on the most frequently used Brazilian ID Cards known as “RG”, so whenever a Brazilian uses their ID, their CPF will be automatically exposed. A CPF is also printed in full in any contract signed by a person in Brazil.

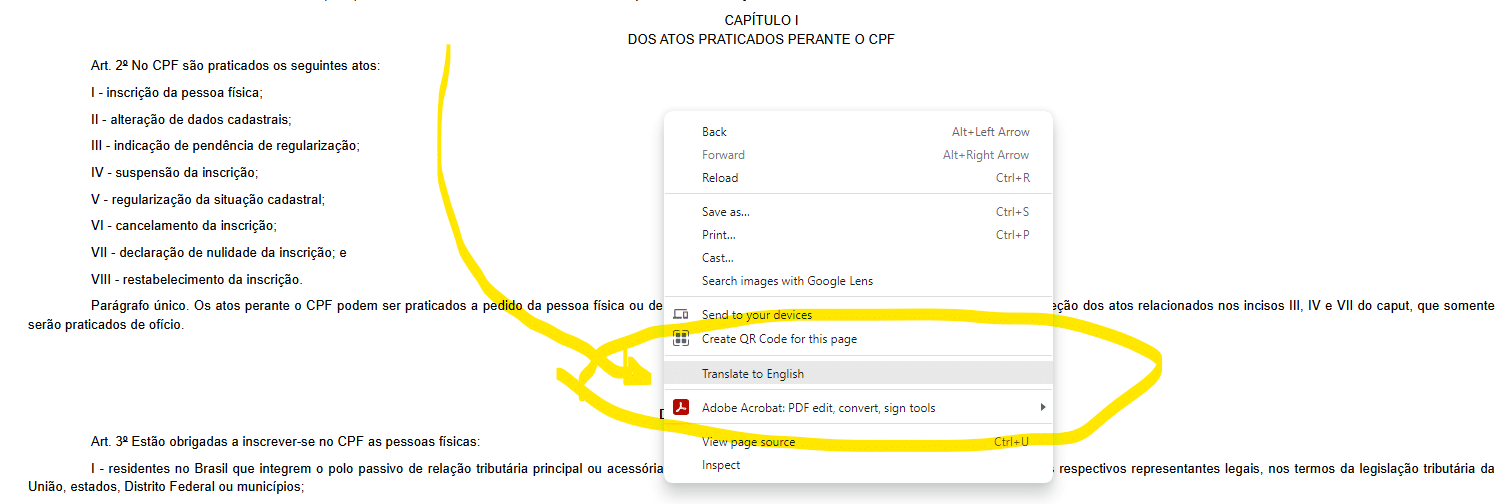

You can take a look at the normative instruction issued by the Brazilian Revenue Service governing the CPF Tax ID number. The IN RFB n° 1548/2015 can be accessed here . Wait! Did you forget I don’t speak Portuguese? Not really! You can simply right-click on this page (Chrome only) and choose “Translate into English.” Chrome does quite a good job, and you will be able to learn about the CPF directly from the horse’s mouth!

If you are in Brazil, visit one of the many Brazilian Revenue Service offices across the country to ask for a search to be done. If you are abroad, you may want to email [email protected] to see if they can retrieve it for you remotely.

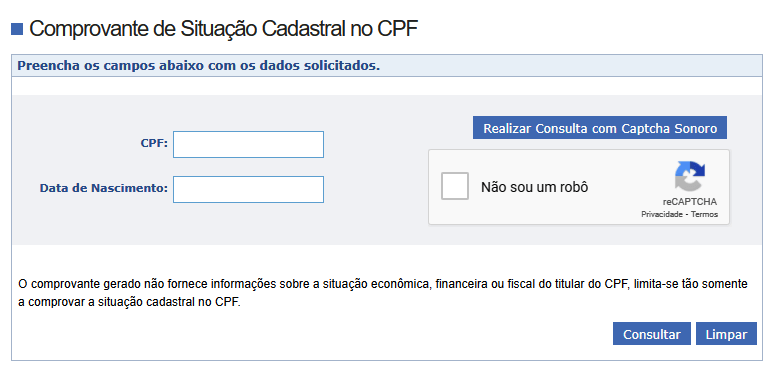

The Brazilian Tax Revenue offers a CPF checker application so you can check the status of your CPF number: https://servicos.receita.fazenda.gov.br/servicos/cpf/consultasituacao/consultapublica.asp

The CPF number should be entered in the first box, while the CPF’s holder’s Date of Birth should be entered in the second one. Note that the DOB format in Brazil is: DD/MM/YYYY.

Need a CPF in Brazil?

We Can Help You

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us to get a free quote, or

#2 Schedule a Consultation now

Become a Pro in Brazil Real Estate!

To learn all about purchasing real estate in Brazil, check our How to Buy Properties in Brazil guide.

Learn about the advantages of buying real estate in Brazil in our Why Buying Real Estate in Brazil guide. Find opportunities and decide where to buy using our Know Where to Buy Real Estate in Brazil guide.

This content is intended for general information purposes only and does not constitute legal advice. For legal issues or decisions of any kind, the reader should retain and consult legal counsel. You should not act or rely on the information on this website without first seeking the advice of an attorney. The determination of whether you need legal services and your choice of a lawyer are very important matters that should not be based on websites or advertisements.