Buy Brazilian Real Estate with Bitcoin—Stress-Free, Fully Compliant

Turn digital money into beachfront sunsets, skyline views, and rock-solid Brazilian deeds—typically in 90 days or less. Our team lets you buy property in Brazil with Bitcoin, Ethereum, USDT, or other coins. We guide you through every Brazilian compliance checkpoint so Bitcoin real estate in Brazil feels as smooth as a domestic closing. Join the growing wave securing Brazil real estate with crypto and buy Brazilian real estate with Bitcoin—minus the stress.

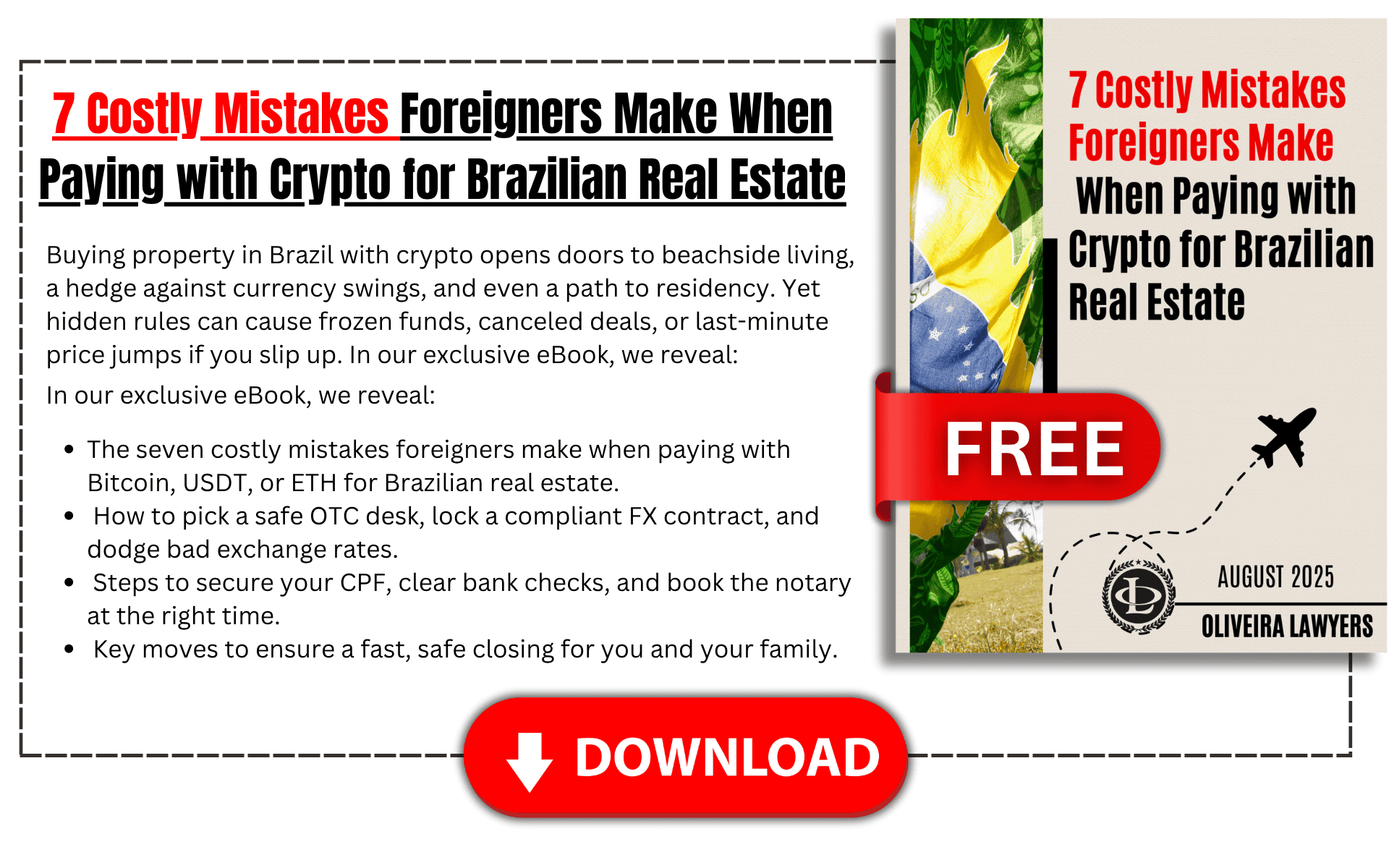

Book Your Consultation | Download the 7 Biggest Mistakes Guide

Book Your Consultation | Download the 7 Biggest Mistakes Guide

Buy property in Brazil with Bitcoin?

We can help.

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us for a free quote, or

#2 Schedule a consultation now.

Why Pay for Brazil Real Estate with Crypto—But Still Respect the Rules

Buying overseas never means skipping bureaucracy—especially in Brazil, where the Central Bank, tax office and local notary each need their own paper trail. What crypto does is let those steps run in parallel instead of in series, shaving weeks off the calendar.

When you buy real estate in Brazil with crypto you still complete the full KYC pack, sign an FX contract and document source of funds. Once those checkpoints are cleared, you unlock four real advantages:

- Synchronized closing (our “emulated escrow”). Hours before the deed ceremony, our OTC partner desk converts your Bitcoin, Ethereum or USDT and pushes the exact BRL amount into the seller’s account. The seller refreshes their app, sees the money, and only then picks up the pen—ideal when you buy Brazilian real estate with Bitcoin.

- Exchange-rate certainty. Our partners can lock your quote the instant you approve it, shielding you from BRL swings that haunt large SWIFT wires—a big win for Bitcoin real estate Brazil investors.

- Partial conversion control. Convert only what you need for the closing; surplus coins zip back to your wallet after closing, so you keep long-term upside intact while holding Brazil real estate.

- Streamlined—not skipped—bureaucracy. By front-loading required documents, our compliance desk can approve your file in days. You still satisfy every rule yet feel reduced gridlock when conducting Brazil real estate with crypto.

Bottom line: You can enjoy almost the same legal assurance a traditional wire offers—yet keep control over timing, privacy and portfolio exposure. That’s our Bitcoin real estate Brazil edge.

Pay for Brazil real estate with crypto?

We can help.

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us for a free quote, or

#2 Schedule a consultation now.

The Three Brazil Real Estate Bureaucratic Monsters We Tame for You

1 · No Escrow Tradition—We Emulate It on Closing Day

In Brazil, escrows are not common and sellers typically refuse to sign closing papers until cleared funds hit their account. We solve the standoff by holding your coins in a segregated OTC wallet and releasing BRL hours before the deed reading.

2 · Cement-Thick FX Regulation

Large wires can freeze for weeks—sometimes up to six—in compliance limbo. As a licensed correspondent of leading exchange banks, we guide you on currency exchange and all paperwork before any satoshi moves. The result? Brazil real estate with crypto approvals usually land in just a few days.

3 · Crypto Skepticism on the Seller Side

Most owners have never held a hardware wallet. We educate them in plain Portuguese and prove same-day BRL delivery. Result: they feel like they got a normal high-value wire, while you buy Brazilian real estate with Bitcoin and keep your upside.

Brazil real-estate bureaucracy stressful?

We can help.

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us for a free quote, or

#2 Schedule a consultation now.

Our 10-Step Process—From Wishlist to Title in 90 + Days

| # | Step | What Happens | Handled By |

|---|---|---|---|

| 1 | Discovery Call | Budget, lifestyle goals, preferred coins for Brazil real estate with crypto. | You + Attorney |

| 2 | Curated Short-List | HD video tours of penthouses, beachfront villas, remote-work lofts. | Realtors |

| 3 | Deed & Lien Sweep | 20-year chain-of-title and lawsuit check for Bitcoin real estate Brazil buyers. | Legal Team |

| 4 | Contract Draft | Add crypto purchase clause—another safeguard when you buy Brazilian real estate with Bitcoin. | Legal Team |

| 5 | Downpayment-Exchange Plan | BTC→BRL path or direct-coin acceptance. | FX Desk |

| 6 | Document Authentication | Apostille + sworn translations. | Legal Team |

| 7 | Final Clearances | Tax zero-balance, condo certs. | Legal Team |

| 8 | Funding Day Prep | OTC locks rate; instant BRL push to seller—key for Brazil real estate closings. | FX Desk |

| 9 | Closing (Escritura) | Seller confirms funds, signs deed. | Legal + Bank + Registry |

| 10 | Title Registration & Residency | Registry flips title; visa packet filed for your Brazil real estate with crypto investment. | Legal Team + Registry |

Average timeline: 90 days door-to-door.

Transfer Bitcoin to Brazil real estate?

We can help.

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us for a free quote, or

#2 Schedule a consultation now.

Brazil Market Snapshot — June 2025

Buying power is clearest in dollars, so we price everything in USD while converting to ft² on hover. These are sample prices from some of our latest Brazil real estate transactions. Naturally, there is a large variation of the price depending on neighborhood, age and quality of construction and finishing materials. It is not uncommon for the square meter to vary over 100 % in the same city.

| City | Avg USD/m² | USD/ft² | What Crypto Buyers Like |

|---|---|---|---|

| Balneario Camboriu | 4,114 | 382.2 | Skyline “vertical yachts” |

| Rio de Janeiro (Leblon) | 3,629 | 337.2 | Penthouse Bitcoin trend |

| Rio de Janeiro (Copa) | 2,330 | 216.5 | Ipanema resale stock |

| Florianopolis | 2,330 | 216.5 | Remote-work paradise |

| Belo Horizonte | 2,875 | 267.1 | Luxury towers, ETH buyers |

| Brasilia | 2 136 | 198.4 | Diplomatic yields |

| Curitiba | 2 078 | 193.1 | Green tech hub |

| Recife | 1 584 | 147.2 | Under US$300k boardwalk |

| Sao Paulo | 1 942 | 180.4 | Multi-coin liquidity |

| Salvador | 1 262 | 117.2 | Surf scene bargains |

(Data: FipeZap, Secovi, IXC extractions.)

Use USDT to buy property in Brazil?

We can help.

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us for a free quote, or

#2 Schedule a consultation now.

Which Coins Clear the Fastest for Brazil Real Estate with Crypto?

- Bitcoin (BTC) — 90 % of volume, deepest liquidity.

- Ethereum (ETH) — Ideal under US$600k.

- USDT & TUSD — Cheap, fiat-parity rails.

- Litecoin (LTC) — Penny-level fees on big transfers.

- INJ + 190 alt-assets — Cleared if OTC desks price them.

These assets settle quickly, making Bitcoin real estate in Brazil closings painless and letting you buy Brazilian real estate with Bitcoin even when markets swing. Fast payment rails matter, because Brazil real estate deals can close in as little as seven days once funds clear.

Every asset must initially pass chain-analysis, so your Brazil apartment purchase cryptocurrency move stays regulator-proof. This is known in Brazil as KYT (“know your transaction”).

Best crypto to buy Brazil property?

We can help.

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us for a free quote, or

#2 Schedule a consultation now.

KYC & Compliance—The Paper Trail Made Painless

Accurate paperwork keeps every Bitcoin real estate deal in Brazil audit-ready and reinforces confidence across Brazil real estate with crypto transactions.

Provide: Passport, selfie, latest tax return, wallet statements, 90-day bank and exchange statements, source-of-wealth forms.

We may add: Chain-analysis report, Portuguese FX contract, apostilled PoA for remote closings. Approval lands 3–5 business days after we receive your file.

Excluded jurisdictions: Cuba, Iran, North Korea, Syria, Russia (incl. Crimea, Donetsk, Luhansk) plus any territory flagged by OFAC/FATF.

Documents needed to buy property in Brazil with bitcoin?

We can help.

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us for a free quote, or

#2 Schedule a consultation now.

Success Stories—From Coins to Keys

These case studies prove you can buy Brazilian real estate with Bitcoin and hold title sooner than many cash buyers in traditional Brazil real estate deals.

Marc L., Canada — Converted BTC into a US$900k Florianópolis condo. Seller verified funds on a banking app; deed signed two minutes later.

Sophia G., Germany — Split BTC + US$200k wire for a US$1.4 m Ipanema penthouse; met the R$1 m visa threshold and gained residency.

Kevin T., USA — Swapped ETH into a US$3 m Fortaleza villa. OTC released BRL at 10:02 a.m.; keys delivered at 10:17.

What Clients Speak

“Seller saw the money, signed the deed—simplest closing I’ve done in Brazil.” — Oliver P., UK

“Bureaucracy handled—my part was two Zoom calls plus one trip to the cartório.” — Linda S., USA

“ETH gains to beach villa in 94 days. Wild by Brazilian standards.” — Denis K., Switzerland

Ready to Own Your Slice of Brazil Real Estate?

Book Your Consultation | Download the 7 Biggest Mistakes Guide

Book Your Consultation | Download the 7 Biggest Mistakes Guide

We are not a money-transmitter; all crypto conversions are executed by regulated partners. In partnership with RE/MAX Nomad Estates (CRECI-SP registered) as a São Paulo OAB law firm.

Brazil crypto property lawyer reviews?

We can help.

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us for a free quote, or

#2 Schedule a consultation now.

Ultimate 20-Question FAQ for Buying Brazilian Property with Crypto

1. Do I need a Brazilian bank account to buy property?

No. When you buy property in Brazil with Bitcoin (or any crypto) the coins land in a segregated OTC wallet, convert to BRL, and may jump straight into the seller’s account on the day of the signing. Post-closing, however, a low-fee digital bank makes life easier for paying utilities and condo fees. We can assist with the KYC and non-resident bank account opening once your Brazil real estate with crypto deal is recorded.

2. How much crypto do I need for earnest-money and is it refundable?

In Brazil there is no “earnest-money.” Instead, buyers are required to provide a down-payment that will go straight into the seller’s pocket. Plan on 5 %–10 % of the negotiated price. This amount will be refunded only under certain rare circumstances (e.g., seller is unable to provide acceptable certificates of clearance for the property by closing time). If you drop the deal without an inspection or title contingency, the seller keeps the crypto.

3. Are property taxes or condo fees payable in crypto?

Not yet. Municipalities and HOAs only accept BRL, but our partner’s desk can potentially convert micro-amounts of USDT or ETH to cover IPTU (annual tax) and condo fees on demand. You can consider batching small conversions so you aren’t spending $10 gas to pay a $3 trash-collection bill.

4. What if Bitcoin’s price tanks between quote-lock and closing?

Risk lives in the gap between network confirmation and BRL arrival—usually a short period. We hedge by trying to book a firm OTC rate after the notary confirms all documents, then push the signed quote to you via WhatsApp for instant approval. Depending on the arrangement, even a 10 % flash crash wouldn’t hurt you if conversion executes before that volatility can manifest.

5. Can I pay entirely in USDT or TUSD without touching BTC?

Yes. Stable-coins clear faster than BTC because blocks are lighter and fees are low. For deals under US $500 k, USDT on Tron is an interesting rail; the OTC desk could potentially see the transfer in minutes, lock the BRL, and wire the seller. For elite villas over US $1 million we can break payment into multiple stable-coin tranches to keep blockchain analytics clean.

6. Will Brazil tax my crypto gains?

Brazil taxes the seller on any capital gain in BRL; foreign buyers generally have no Brazilian CGT exposure unless you are the end account holder of the funds coming from a cryptocurrency. You typically remain liable in your home country.

7. Can I split the price between bank wire and multiple cryptocurrencies?

Absolutely. A typical structure for residency hunters is US $200 k wired (hitting the R$1 million visa threshold for the “Brazil Real Estate Investor Visa”) plus the balance in BTC, ETH and even USDT.

8. Does a crypto-funded purchase count toward Brazil’s investment visa?

Yes—if at least R$1 million (~US $195 k) travels through the Brazilian banking system after a traditional bank wire is initiated abroad. We wire that tranche first, then inject the remainder in BTC. The immigration attorney packages the deed, SWIFT receipt and Crypto-to-BRL proof into a single application, satisfying the requirements of the “Brazil Real Estate Investor Visa” (also known as Brazil Golden Visa or Brazil Viper Visa).

9. How much are closing costs?

Budget 3 %–5 % all-in: ITBI transfer tax (2 %–3 %), notary (≈ 0.9 %) and registry (≈ 0.8 %). Luxury markets—Rio, Sao Paulo—sit at the upper end; Salvador and Recife trend lower. Because costs are flat BRL, paying with crypto doesn’t typically inflate the bill.

10. What ongoing taxes will I pay?

IPTU (annual property tax) averages 0.3 %–1 % of the cadastral value—often below US big-city rates. Condo fees run US $1–$3 per sq ft annually, depending on amenities.

11. Can I Airbnb the property?

Rio and Sao Paulo allow short-lets in most buildings; Florianopolis and Balneario Camboriu have 30–90-day minimums in high-rise condos. We scrutinise by-laws upon request so your Fortaleza beachfront penthouse Bitcoin purchase doesn’t get hit with rental bans.

12. Do I need to be in Brazil for closing?

Not necessarily. Alternatives include a Hague-apostilled Power of Attorney and the e-Notariado system, letting our OAB-barred lawyer sign, wire, and collect keys. Remote closings now outnumber in-person ones 3-to-1.

13. How long can I stay in Brazil on a tourist stamp?

Citizens of the US, EU, UK and Canada may stay 90 days per visit, 180 days per year. Investment residency bumps you to a four-year residency and later on permanent status; with a stamped RNE card you can live, work, or even open a local crypto-friendly bank account.

14. Can I buy rural land with crypto?

Urban plots are wide open. Rural parcels may require special authorisations depending on the size. Many registries will not allow a closing unless you already have a valid RNM (resident) card. If you crave farmland we can vet acreage caps in advance.

15. Which documents need an apostille?

Passport copy, Power of Attorney, corporate formation papers, and any foreign birth/marriage certificates depending on your marital status.

16. How do you prove long-term Bitcoin holdings?

Our partners may create a wallet timeline showing blocks older than 365 days, bolstered by Chainalysis reports. If coins moved through mixers or high-risk exchanges, our partners may pre-emptively flag them for compliance to maintain their “green” risk score. Coins with low-reputation chain-analysis may be declined by our OTC partners.

17. What if my crypto sits on Binance or Coinbase?

You may temporarily withdraw to an OTC wallet; the exchange’s PDF statement plus the blockchain TXID can potentially satisfy the “KYT” (know your transaction) while KYC may be required on both you and the seller.

18. Can we use hardware-wallet escrow or multisig?

Potentially yes. For larger deals our partners often build a 2-of-3 multisig (buyer key, OTC key, law-firm key). Funds can’t move unless at least two parties sign, mirroring traditional escrow.

19. Can reservation and earnest-money come in different coins?

Yes. Many tech founders drop USDT on Tron for reservation (cheap gas) then fund the balance with BTC or ETH once due diligence clears.

20. Are property taxes or condo fees payable in crypto?

Still BRL-only, but we can batch small conversions to minimise gas costs.