The Definitive Guide to the Brazilian CPF for Foreign Citizens in 2026

What is the CPF Number?

The CPF, a single eleven-digit number, serves as the connector between the individual to the state, the economy, and society at large in Brazil. The Cadastro de Pessoas Físicas (CPF), or Individual Taxpayer Registry, has evolved far beyond its original mandate as a fiscal tracking tool for the Federal Revenue Service (Receita Federal do Brasil – RFB). Today, the CPF stands as the foundational digital identity for foreign nationals, expatriates, and international investors seeking access to the largest economy in Latin America.

Whether the objective is acquiring high-value real estate in São Paulo, establishing a business entity in Brazil, or simply accessing the ubiquitous Pix instant payment network as a digital nomad, the possession of a regular, active CPF is the non-negotiable prerequisite.

While the bureaucratic friction to obtain a CPF has increased, so too has the utility of the document. We advise clients requiring expedited, error-free processing to utilize the Oliveira Lawyers Remote Assistance Service (USD 325), ensuring legal compliance and operational readiness without the logistical burden of international travel or consular scheduling.

Oliveira Lawyers helps English-speaking foreign citizens obtain a Brazilian CPF that actually works in real life (bank KYC, notary/registry, fintech onboarding) by handling the process end-to-end:

- Document strategy: we review your passport plus supporting civil documents to reduce “filiation” and data mismatch problems later.

- Attorney-led filing: we organize the correct path (consulate vs proxy) and keep the case moving without trial-and-error.

- Status protection: we aim to prevent the common “regular CPF with wrong background data” issue that blocks banks and services later.

Brazilian CPF for Foreign Citizens (2026)?

We Can Help—Start the Right Way.

#1 Contact us for a free quote, or

#2 Schedule a Consultation now.

1. CPF: From Tax ID to Key to Life In Brazil

To understand the red tape of the 2026 application, one must first appreciate the expanded role of the CPF within Brazil’s life. Historically, the CPF was analogous to the US Social Security Number strictly in its fiscal capacity. However, the last decade of digitalization has transformed it into the primary key for the Carteira de Identidade Nacional (CIN – national identification card) and the unified federal database.

CPF as the Ultimate ID

The modernization of Brazil’s public administration has been driven by a drive to integrate disparate databases – electoral, fiscal, and civil. The CPF is the unique index key across these systems. When a foreigner attempts to purchase a SIM card in Rio de Janeiro, the telecom operator’s system typically queries the Receita Federal database in real-time to validate the CPF status. If the status is “Suspended” or the data does not match the input (e.g., a misspelling of the mother’s name), the transaction is blocked at the point of sale.

Who Needs a CPF?

The misconception persists that only those earning income in Brazil require a CPF. The regulations are explicit and far broader. Registration is mandatory for any foreign citizen, resident or non-resident, who possesses or wishes to possess assets or rights subject to public registration in Brazil. This includes:

- Real Estate Investors: No property deed (Escritura Pública) can be issued without the buyer’s CPF. This applies to both spouses in a marriage regime.

- Financial Market Participants: Opening any bank account, including the simplified Non-Resident Bank Account a.k.a. Conta de Domiciliado no Exterior (CDE), requires a CPF. This extends to investments in the capital markets and participation in Brazilian corporate entities.

- Corporate Shareholders: Foreign individuals appearing as the Ultimate Beneficial Owners (UBOs) of foreign holding companies with assets in Brazil must have individual CPFs to satisfy the chain of custody requirements of the Receita Federal.

- Participants in a probate: no foreign citizen may receive inheritance in Brazil without first securing a CPF. And, there is more. Even the heirs spouses will have to get one before the probate can move.

- Property Rentals: got a nomad visa and now looking for a rental? A CPF and a passport will be the bare minimum to be able to rent a property for a one or more year lease.

- Everyday Consumers: Utility contracts (electricity, internet), mobile phone plans, and even online purchases from major retailers often hard-gate checkout processes behind a CPF validator.

The universality of this requirement dictates that the CPF is often the first step in any Brazilian venture, preceding visas, travel, or contract negotiation.

2. How to Get a CPF in 2026

With the closure of the direct email channel for new applications since 2023, foreign nationals are now presented with two choices to acquire while abroad. This decision typically hinges on these constraints: Time, Cost, and Geography.

If you have time in your hands and visiting a Brazilian consulate is feasible, that’s typically your best option. For those who don’t live near a consulate or don’t have hours to spend on learning, scheduling, traveling, and attending the appointment, using a legal service is usually the best choice.

2.1 Abroad Option #1: The Consulate

This pathway remains the default administrative route provided by the Ministry of Foreign Affairs (Itamaraty). It is designed for individuals who have physical proximity to a Brazilian diplomatic mission and possess the time and patience to navigate variable scheduling systems.

- Mechanism and Jurisdiction: Brazilian consulates operate on strict jurisdictional lines. A resident of Texas must apply to the Consulate of Brazil in Houston; they cannot apply to the Consulate of Brazil in New York or Miami. This jurisdictional enforcement requires proof of residence (typically a driver’s license) within the consulate’s specific territory.

- The E-Consular Bottleneck: The primary friction point in this pathway is the e-consular system adopted by almost all consulates. This digital scheduling platform acts as a gatekeeper.

- Process: The applicant must upload scans of all documents for pre-validation. Only after a consular agent manually approves the digital dossier (which can take days or weeks) is the calendar for in-person appointments unlocked.

- Availability: Appointment slots are finite and often scarce, particularly in high-demand jurisdictions like Lisbon, Miami, or London. Wait times for the next available slot can range from 15 days to a few months.

- Execution: On the day of the appointment, the applicant must physically appear with original documents. The consular agent processes the request, which is then transmitted to the Receita Federal in Brazil. The CPF number is typically not issued instantly; it may be emailed or generated days later depending on the specific consulate’s workflow.

Cost-Benefit Analysis:

While technically “free” (most consulates do not charge for the CPF service itself), the substantial hidden costs of learning, travel, time off work, and the unpredictable wait times make this pathway less viable for business professionals or those with urgent closing deadlines.

2.2 Abroad Option #2: The Attorney “Concierge” Route

Recognizing the logistical challenges of the consular route, the Brazilian legal code permits the issuance of tax registrations through a Procurador (Proxy). This pathway utilizes a specific, limited Power of Attorney (Procuração) to bridge the physical gap between the foreign applicant and the Receita Federal.

- Mechanism of Agency: In this model, the foreign national grants Oliveira Lawyers specific powers to represent them before the Federal Revenue Service. This is not a general power of attorney; it is strictly limited to tax registration acts.

- The Digital Dossier: The legal team assembles a Dossiê Digital de Atendimento (DDA) containing the applicant’s notarized identification, the translation of relevant biodata, and the formal petition for entry into the Cadastro de Pessoas Físicas.

- Direct Filing: Instead of relying on consular transmission, the application is filed directly with the Receita Federal’s specialized units in Brazil. This bypasses the Itamaraty infrastructure entirely.

Strategic Advantage:

The primary value proposition of this pathway is speed and error resolution.

- Speed: Without the need to wait for a consular appointment slot, the filing can occur as soon as the documentation is received.

- Resolution: Should the system flag a homonym (a common name match) or a data inconsistency, the attorney—being a registered legal representative—can interact directly with the tax auditor to resolve the block. In the consular route, such issues often result in the applicant being told to “contact the Receita in Brazil,” leaving them stranded.

Oliveira Lawyers Remote Assistance Service:

We have standardized this process into a turnkey solution for USD 325. This fee encompasses the drafting of the bilingual POA, the review of all civil documents to prevent “filiation” errors (discussed in Section 6), and the active monitoring of the application until the digital certificate is issued.

Oliveira Lawyers can run the attorney-backed CPF pathway as a true “concierge” service—so your CPF is issued with clean data and fewer surprises later:

- POA + filing package: drafting and instructions for a limited power of attorney focused on CPF acts.

- Filiation/data integrity review: preventing mother’s name / DOB / name formatting issues that trigger KYC blocks.

- Monitoring + follow-ups: handling Receita Federal requests instead of leaving you stuck abroad.

Need a CPF Without Consulate Wait Times?

Attorney Proxy Filing Can Be the Fast Path.

#1 Contact us for a free quote, or

#2 Schedule a Consultation now.

2.3 In-Country Application: The “Local” Route

For foreigners physically present in Brazil, the process theoretically involves visiting a Correios (Post Office), Banco do Brasil, or Caixa Econômica Federal branch.

- The Reality: While inexpensive (approx. BRL 7.00), this route is fraught with practical difficulties. Front-line clerks are often untrained in handling foreign passports, particularly those that do not list parents’ names (like US or UK passports).

- Data Entry Errors: It is common for clerks to mistype names or omit the mother’s name, creating a “regular” CPF with incorrect background data. This “dirty data” can cause severe headaches when attempting to open bank accounts or pass rigid KYC checks later, often requiring a complex regularization process to fix.

- The Language Barrier: Clerks unable to communicate with a foreign citizen in English may present different excuses such as telling you that “the system is down”, they are “not processing CPFs at this time”, among other creative ways to end the awkward situation.

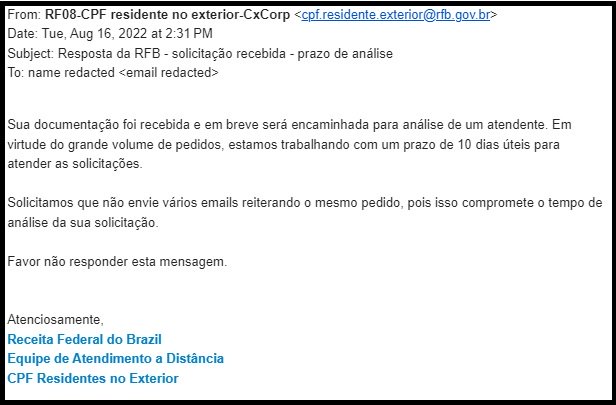

Note: the “Email Method”—the practice of emailing PDF applications to [email protected] — is obsolete for new registrations as of late 2023, following Joint Ordinance COCAD/COGEA No. 53/2023.

3. Comparing the routes abroad

Time is often the critical constraint in many situations in which a foreign citizen needs a Brazilian CPF. The choice of pathway significantly impacts the critical path of these transactions.

Delays and Redos at the Consulate:

The consular timeline is non-linear. A client might prepare their documents in one day but face a 45-day wait for the next available appointment slot in Toronto or London. Furthermore, if documents are rejected at the window (e.g., for lack of a specific translation), the process resets, and a new appointment must be booked.

In contrast, the Remote Assistance protocol runs on a strictly linear timeline. Once the POA is signed and the documents are uploaded to our secure portal, the filing is immediate. The processing time at the Receita Federal for attorney-backed requests is typically 3 to 5 business days.

Doing it While Physically in Brazil:

In Brazil we typically recommend you to visit any of the Brazilian Revenue Offices throughout Brazil. Most applicants can secure a Brazilian CPF in up to 30 days between their first visit to the Brazilian Revenue Service and the issuance of the CPF number.

4. The FCPF Form

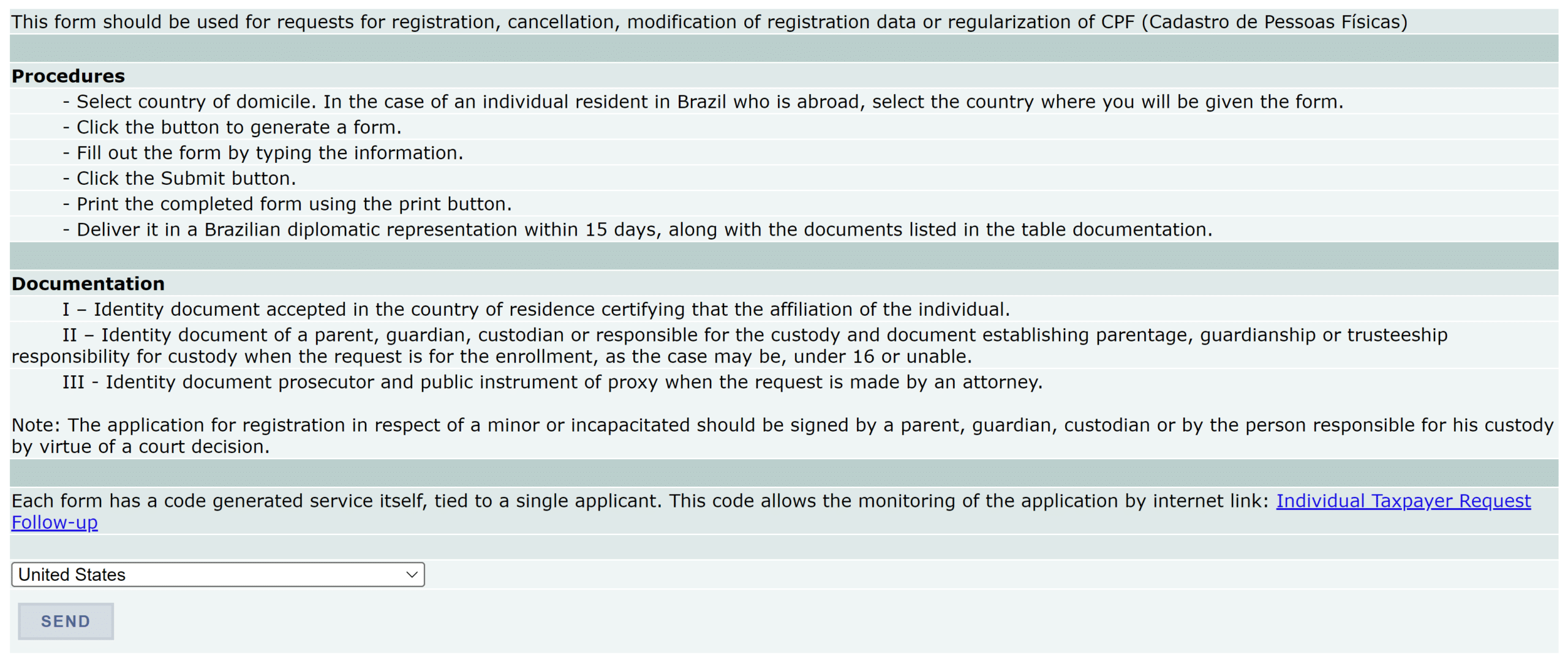

For those proceeding with the consular or self-guided route, the Ficha Cadastral de Pessoa Física (FCPF) is the primary interface. This form is accessible at: https://servicos.receita.fazenda.gov.br/Servicos/CPF/cpfEstrangeiro/Fcpf.asp and this is the first screen you will find:

Make sure to select your country of residence and NOT Brazil.

Once you have chosen correctly, click on “Send” and you will be redirected to the next step, which is generating you CPF Tax ID application form.

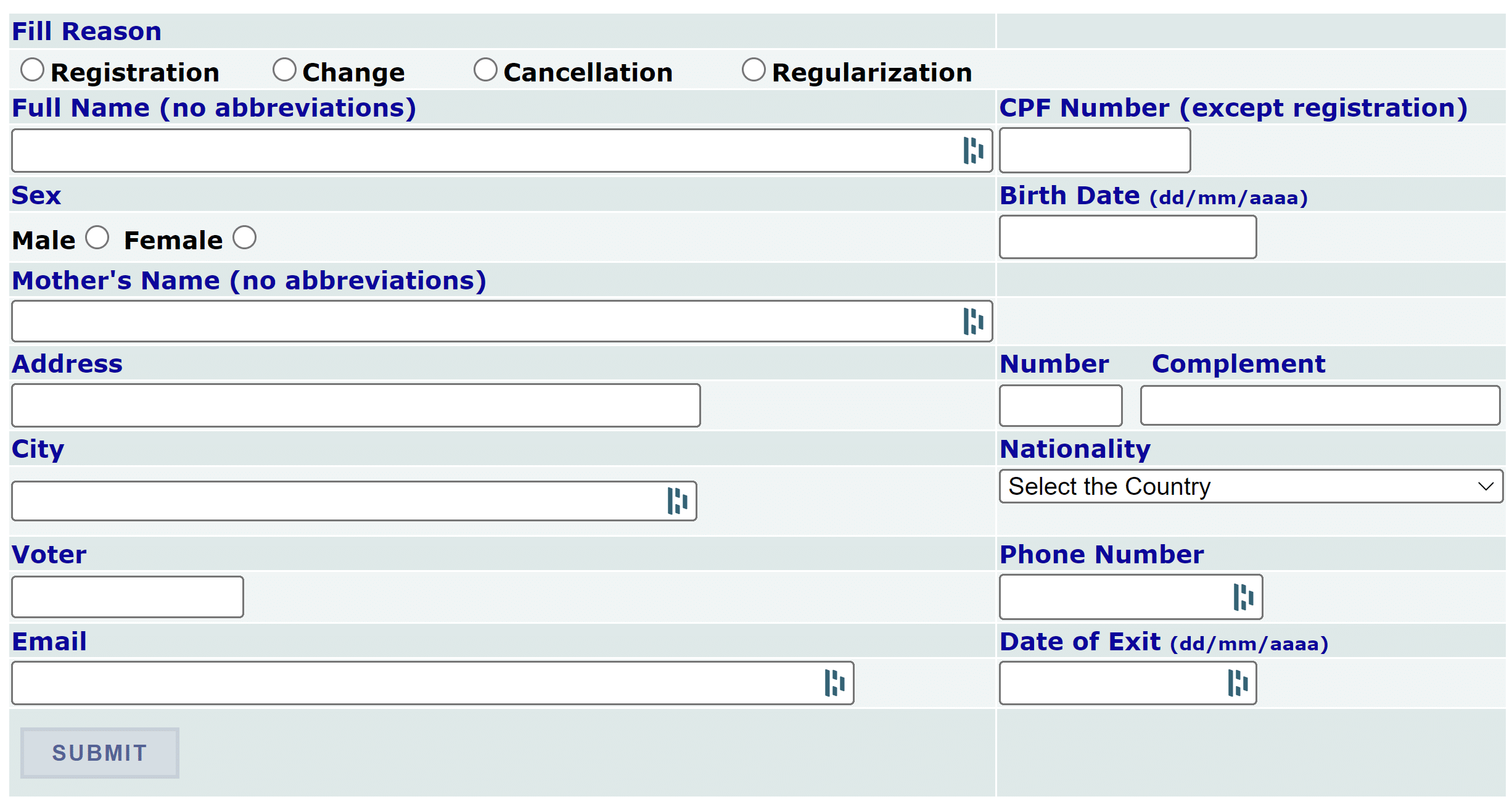

This online form is notorious for its poor user experience design regarding foreign applicants. Understanding its pitfalls is essential to avoid immediate rejection.

4.1 The “Título de Eleitor” (Voter ID) Anomaly

The most pervasive error encountered by foreign applicants involves the “Voter ID” field. The online form is a unified interface for both Brazilian citizens and foreigners.

- The Glitch: When a user navigates to the English version of the form, the “Voter ID” field should theoretically be disabled or optional. However, browser caching issues or selecting “Brazil” as the country of residence (even erroneously) can trigger the field to become mandatory.

- The Consequence: Foreigners obviously do not possess a Brazilian Voter ID. Attempting to bypass this by entering “0000”, “1234”, or random numbers results in an immediate mismatch error with the Superior Electoral Court (TSE) database, suspending the application before it even begins.

- The Protocol: Applicants must explicitly leave this field blank. If the form insists on an input, it is a sign of a session error. The user must clear their browser cache, restart the session, and ensure “Country of Nationality” is correctly set to their foreign origin before attempting to fill other fields. Consulates explicitly warn that pop-up blockers must be disabled, as the final submission receipt opens in a secondary window; failure to allow this often leaves the applicant without the generated protocol number required for the appointment.

4.2 The “Mother’s Name” Requirement

In Anglophone jurisdictions, the passport is the standard identity document. In Brazil, the Civil Registry relies heavily on filiation – specifically the mother’s name – to distinguish between individuals with identical names (homonyms).

- The Mismatch: A US or UK passport typically does not list parents’ names. If a foreigner applies using only their passport, the Receita Federal agent may enter the mother’s name as “Não Consta” (Not Stated) or make a transcription error.

- The Impact: This creates a “low-quality” CPF record. When this individual later attempts to open a bank account, the bank’s KYC system will demand a birth certificate. If the bank enters the mother’s name from the certificate, but the CPF record says “Not Stated,” the system may reject the account opening due to “Dados Cadastrais Inconsistentes” (Inconsistent Registration Data).

- Best Practice: We advise that all CPF applications be supported by a birth certificate or a marriage certificate that explicitly lists parental lineage. This ensures the CPF is created with full “Level 2” data quality from day one, preventing future banking or service provider blocks.

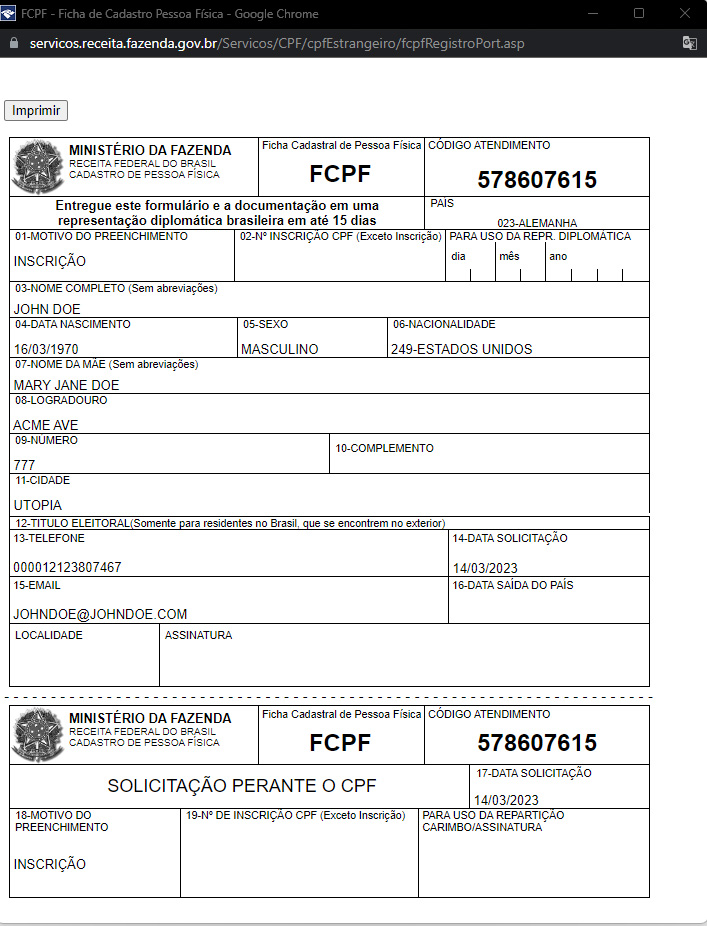

4.3. Printing the Resulting Application

Once you finish entering information, click on “Submit” to move to the next step.

Important: make sure you authorize “pop-up” for the ready-for-print form to be made available!

That’s how the form should look like:

Your application form will be issued digitally, and it will be already filled with some of the information you submitted in the previous step.

Sign the form! You need to sign the form under “Assinatura” and enter the city where you are under “Localidade”. Then, scan the form.

4.4 Take a clear picture of your passport

You need a clear picture or scanned copy of your passport.

Make sure everything is readable and your face is also showing clearly. Some passports have a plastic layer on top of the paper that may cause issues when a flash or bright light is used when taking a picture.

4.5 Take a selfie of yourself holding your passport

Use this example below as a guideline of how your picture should look like:

You will then upload these files into the Consulate Appointment system for further processing. Need our help to operate the Consulate system on your behalf? We can help you.

If you’re doing the consular route, the most common pain points are not “legal”—they’re operational: wrong uploads, missing civil documents, pop-up/receipt issues, and inconsistencies in names and filiation data.

Oliveira Lawyers can help you prevent avoidable rejections by:

- reviewing your FCPF form inputs (especially filiation and nationality/residence fields),

- helping you prepare a consulate-ready file package (scan quality + correct structure), and

- reducing the risk of “Voter ID” and “data inconsistency” traps that stall the process.

Consulate CPF Process / FCPF Form Confusing?

We Can Help You Avoid Rejections.

#1 Contact us for a free quote, or

#2 Schedule a Consultation now.

5. Banking and Money Services

For the majority of our clients, the CPF is a means to a financial end. The Brazilian banking landscape in 2026 has evolved, offering new opportunities for non-residents that were previously unavailable, provided the CPF is in order.

5.1 Non-Resident Bank Accounts

Historically, opening a bank account as a non-resident was a privilege reserved for ultra-high-net-worth individuals due to the regulatory burden and high costs of the Non-Resident Bank account a.k.a. Conta de Domiciliado no Exterior (CDE).

- 2026 Landscape: Regulatory easing and the rise of fintechs have democratized access. Institutions like Banco Rendimento, BTG Pactual, and Ouribank now offer accessible CDE accounts.

- The Role of CPF: These accounts are digital-first. The onboarding flow begins with the input of the CPF. If the CPF is regular, the process proceeds to passport scanning. If the CPF is “Pending” or has a name mismatch, the flow terminates.

- Cost: While some traditional banks still charge high maintenance fees, newer entrants offer competitive rates (e.g., Rendimento’s basic plans) specifically targeting the “global citizen” demographic.

5.2 Money Apps and Payment Accounts

For those who do not require a full-fledged non-resident bank account, “payment institutions” offer a middle ground.

- Wise (formerly TransferWise): Allows users to hold BRL balances. Wise requires a CPF to generate a BRL account detail for residents, or to facilitate transfers. While restrictions exist for non-residents holding BRL indefinitely without a non-resident bank account structure, Wise remains the primary rail for moving funds into Brazil for tourism or small expenses

- Nomad & Banco Inter: These platforms bridge the US-Brazil gap. Nomad (partnered with Ouribank) caters to Brazilians wanting US accounts, while Banco Inter has expanded to offer “Global Accounts.” For a foreigner, having a CPF allows access to these ecosystems, facilitating seamless currency exchange.

5.3 Pix: Zelle on Steroids

Familiar with Zelle in the US? Pix is just like Zelle but 10 times better. Brazil’s instant payment system, Pix, is ubiquitous. It is used for everything from purchasing real estate to paying for a coconut on the beach.

- The Exclusion: You cannot use Pix without a Brazilian bank account (or payment account). You cannot have a Brazilian bank account without a CPF.

- The Key: Once a non-resident bank or Fintech account is opened, the CPF usually serves as the primary “Pix Key” (Chave Pix). This allows the foreigner to receive funds instantly from any person in Brazil by simply sharing their CPF number, eliminating the need for complex IBAN/SWIFT codes for domestic transfers like it happens in Europe.

If your end-goal is banking access (CDE accounts, fintech onboarding, and Pix), the CPF cannot be “just any CPF”—it needs clean data that matches the documents banks will request later.

Oliveira Lawyers can help align your CPF registration data with practical KYC requirements:

- Data match planning: avoiding the “mother’s name doesn’t match” scenario that blocks onboarding.

- Non-resident positioning: support around correct setup when you live abroad and want the CPF to be usable.

- Troubleshooting: helping fix issues early before the bank or fintech rejects you.

CPF for Bank Accounts or Pix in Brazil?

We Can Help You Get a CPF That Passes KYC.

#1 Contact us for a free quote, or

#2 Schedule a Consultation now.

6. Real Estate and Business Entities

The CPF is the data anchor for property and corporate registries (meaning any type of business entity).

6.1 Law 6.015 and the Public Registry

The Public Records Law (Lei de Registros Públicos) mandates the identification of parties in any property deed. The CPF is the statutory identifier.

- Joint CPF: Although joint CPF for a couple was common 50 years ago, nowadays each spouse must have their own individual CPF to be named on the deed. If only one spouse has a CPF, the property is precluded from being recorded until the other gets their CPF. And, lie about your civil status in a public document and now you have committed a crime.

- Due Diligence: The Certidão de Ônus Reais (Lien Certificate) and legal background checks are indexed by CPF. Without one, a buyer cannot effectively audit the seller, nor can the buyer be registered as the new owner. Knowing the CPF of the seller will also allow you to run a credit report on the seller which, in Brazil, will uncover among other things, debt, lawsuits, income level, and even corporations the seller owns.

6.2 Corporate UBO (Ultimate Beneficial Owner)

Foreign holding companies (LLCs, Ltds) investing in Brazil are subject to Normative Instruction 1863.

- The Requirement: The foreign entity (CNPJ) must declare its chain of ownership down to the natural person level. These “Ultimate Beneficial Owners” must be identified by a CPF.

- The Bottleneck: We frequently see M&A deals or corporate incorporations stalled because the foreign shareholders—sitting in New York or London—neglected to obtain their individual CPFs. The Brazilian Trade Board (Junta Comercial) will refuse to register the company’s articles of incorporation until these CPFs are presented.

For transactions with deadlines (real estate closing, corporate filings, investment steps), the CPF is often the “blocking item”—especially when spouses or UBOs are missing CPFs or when CPF data does not match civil documents.

Oliveira Lawyers helps foreign investors reduce deal friction by:

- coordinating CPF issuance for all required individuals (including spouses and UBOs),

- preventing registry/bank blocks caused by incorrect filiation data, and

- supporting a cleaner timeline so deals don’t stall at the notary, registry, or Junta Comercial stage.

CPF for Buying Property in Brazil or Setting Up a Company?

We Can Help You Remove the CPF Bottleneck.

#1 Contact us for a free quote, or

#2 Schedule a Consultation now.

7. Probate & Inheritance

Inheritance in Brazil is a strictly formal process that requires a Partilha (Partition of Assets) to be registered with the government. For foreign heirs, the CPF is the bridge between the deceased’s estate and their own legal patrimony.

7.1 The “Espólio” Deadlock

When a person dies leaving assets in Brazil, those assets form an Espólio (Estate). The Espólio is a temporary legal entity that cannot transfer assets to a “ghost” – which, in the eyes of the Brazilian system, is anyone without a CPF.

- The Requirement: Every heir—whether a spouse, child, or beneficiary named in a will—must have a valid CPF to be included in the formal inventory (Inventário).

- The Consequence: Without the heir’s CPF, the inventory process halts. The judge or notary cannot issue the Formal de Partilha (the document that assigns ownership). We have seen probate cases delayed for months simply because one foreign heir in a group of five lacked a tax ID.

7.2 The ITCMD Tax Hurdle

Inheritance in Brazil triggers a state tax known as ITCMD (Imposto sobre Transmissão Causa Mortis e Doação).

- The Payment: State treasury systems generate the tax slip (Guia de Recolhimento) linked to the heir’s CPF.

- No CPF, No Payment: You literally cannot pay the inheritance tax without a CPF. If you cannot pay the tax, the asset transfer cannot be registered. For heirs abroad, obtaining the CPF is the very first step in the probate checklist.

If a Brazilian probate (Inventário) is stalled because one or more foreign heirs do not have CPFs, timing and coordination matter.

Oliveira Lawyers can help foreign heirs and families by:

- obtaining CPFs for heirs abroad so the inventory can proceed,

- reducing document-related rejections (identity + filiation consistency), and

- supporting practical next steps when the estate cannot move without CPF-linked filings and payments.

CPF for Inheritance / Probate in Brazil (Inventário)?

We Can Help Foreign Heirs Unblock the Process.

#1 Contact us for a free quote, or

#2 Schedule a Consultation now.

8. Property Rentals

Whether you are looking to monetize a vacation property or find a place to live for a few months, the CPF is the standard currency of trust and compliance in the Brazilian rental market.

8.1 The Foreign Landlord

If you own property in Brazil and wish to rent it out, you are technically earning Brazilian-sourced income.

- Real Estate Agencies: Reputable agencies (Imobiliárias) will not manage a property for a landlord who does not have a CPF. Their systems require it to generate the monthly statements and to report the transaction to the Receita Federal (via a declaration called DIMOB).

- Tax Compliance: Rental income received by non-residents is subject to a flat 15% withholding tax (or the Carnê-Leão if received from individuals). The tax payment vouchers are indexed to your CPF. Failing to pay this can lead to your CPF being suspended for tax evasion, which effectively freezes your ability to manage the property.

8.2 The Foreign Tenant

Finding a long-term rental in Brazil without a CPF is notoriously difficult.

- Digital Platforms: A major rental platform in Brazil, for instance, automates the entire renting process while relying on the CPF for identity verification and credit checks. Foreigners without a CPF are simply blocked at the sign-up or contract generation stage.

- Offline deals: Lacking of a CPF is a clear signal to the landlord and rental agency that you are simply not viable for a longer term rental (meaning anything more than just airbnb). CPF shows the bare minimum of legal diligence when it comes to property rentals and many landlords will also want you to have a RNM card before agreeing to the perceived increased risk of renting to a foreign citizen.

- Utilities: Even if you find a landlord willing to rent to you without a CPF, connecting electricity (Enel/Light) or internet (Vivo/Claro) in your name requires a CPF. Without it, you are dependent on the landlord keeping the bills in their name, which is a liability they often refuse. Here, too, a RNM card may also be required depending on the utility company.

9. Everyday Consumer Purchases

Brazil has a unique “fiscal citizenship” culture where identification is embedded in commerce. For the foreign resident or long-term tourist, the lack of a CPF transforms simple purchases into complex obstacles.

9.1 The “CPF na Nota” Barrier

Brazilian invoicing laws require merchants to issue a Nota Fiscal (invoice) for every sale. This electronic invoice requires the buyer’s CPF.

- E-Commerce Lockout: Major retailers like Amazon Brasil, Mercado Livre, and Magazine Luiza have hard-coded the CPF requirement into their checkout flows. You cannot create an account or complete a purchase with just a passport number. We frequently hear from clients who are baffled that they cannot order simple household items online.

- Delivery Logistics: Delivery services often use the CPF to verify the identity of the recipient upon delivery, adding another layer of friction for those without one.

9.2 Connectivity and Culture

- SIM Cards: While regulations technically allow foreigners to register prepaid SIM cards with a passport, the practical reality is different. Most pharmacy kiosks and automated systems only accept a CPF. Finding a store employee trained to bypass the CPF field is a “treasure hunt” that frustrates many travelers.

- Events and Entertainment: To prevent ticket scalping, platforms like Ticketmaster Brasil and Eventim (which sell tickets for major festivals and soccer matches) often require a CPF to register and buy tickets. The tickets are nominal (linked to the name/CPF), and you may be asked to prove ownership at the gate.

Many clients come to us after discovering that “life admin” in Brazil (SIM cards, online shopping, utilities, contracts) breaks without a CPF—and that a CPF with inconsistent background data can be just as problematic.

Oliveira Lawyers can help you get a CPF set up correctly so it functions across platforms:

- CPF application support: for foreign citizens who need the number for daily life in Brazil.

- Data consistency: reducing the risk of mismatches that trigger automated CPF validators.

- Practical guidance: aligning the CPF path with your real objective (travel, relocation, banking, purchases).

Stuck Because a Website Requires CPF?

We Can Help You Get a Working CPF.

#1 Contact us for a free quote, or

#2 Schedule a Consultation now.

10. International Shipments

A frequently overlooked but critical area is the receipt of packages from abroad. Since January 1, 2020, the Receita Federal has enforced a strict rule regarding international postal shipments.

10.1 The “Return to Sender” Rule

Brazil’s customs system requires the identification of the importer (the recipient) for every incoming package, regardless of value.

- The Mandate: The recipient’s CPF must be included on the shipping label or the commercial invoice.

- The Consequence: If a friend sends you a gift, or you order something from a foreign website, and the package arrives at Brazilian customs without a CPF linked to it, it will not be released. In many cases, it is immediately marked for “Return to Sender” or destruction. You cannot simply go to the post office to pick it up; the rejection happens at the port of entry.

10.2 The “Minhas Importações” Portal

To manage incoming packages, residents use the Minhas Importações portal on the Correios website. Accessing this portal to pay import duties or link a shipment to your identity is impossible without a valid CPF. For foreigners expecting personal effects or documents via courier (DHL/FedEx), the lack of a CPF can result in the shipment being held indefinitely.

11. Tax Residency

Possessing a CPF does not, in itself, trigger tax residency. However, it is the mechanism by which residency is tracked.

11.1 Non-Resident vs. Resident Status

- Non-Resident (The Default): A foreigner living abroad with a CPF is classified as a “Non-Resident.” They are generally not required to file an annual income tax return unless they have taxable income in Brazil (e.g., rental income) subject to exclusive source taxation.

- Resident (The Shift): Tax residency is triggered if the foreigner enters Brazil with a permanent visa, or enters on a temporary visa and remains for more than 183 days within a 12-month period.

- The Implication: Once triggered, the CPF status shifts to “Resident,” and the individual becomes liable for taxes on their worldwide income.

- Oliveira Lawyers Safeguard: When we process the CPF via our Remote Service, we strictly register the applicant as a Non-Resident. This ensures that the Receita Federal’s automated systems do not expect an annual tax return, preventing the “Pending Regularization” status from appearing erroneously.

12. Compliance and Troubleshooting

A significant volume of inquiries in 2026 stems from foreign nationals who already possess a CPF but find it unusable due to status irregularities. The Receita Federal’s systems have become increasingly aggressive in flagging potential tax evasion, often catching innocent non-residents in the net.

12.1 CPF Status Issues and Potential Fixes

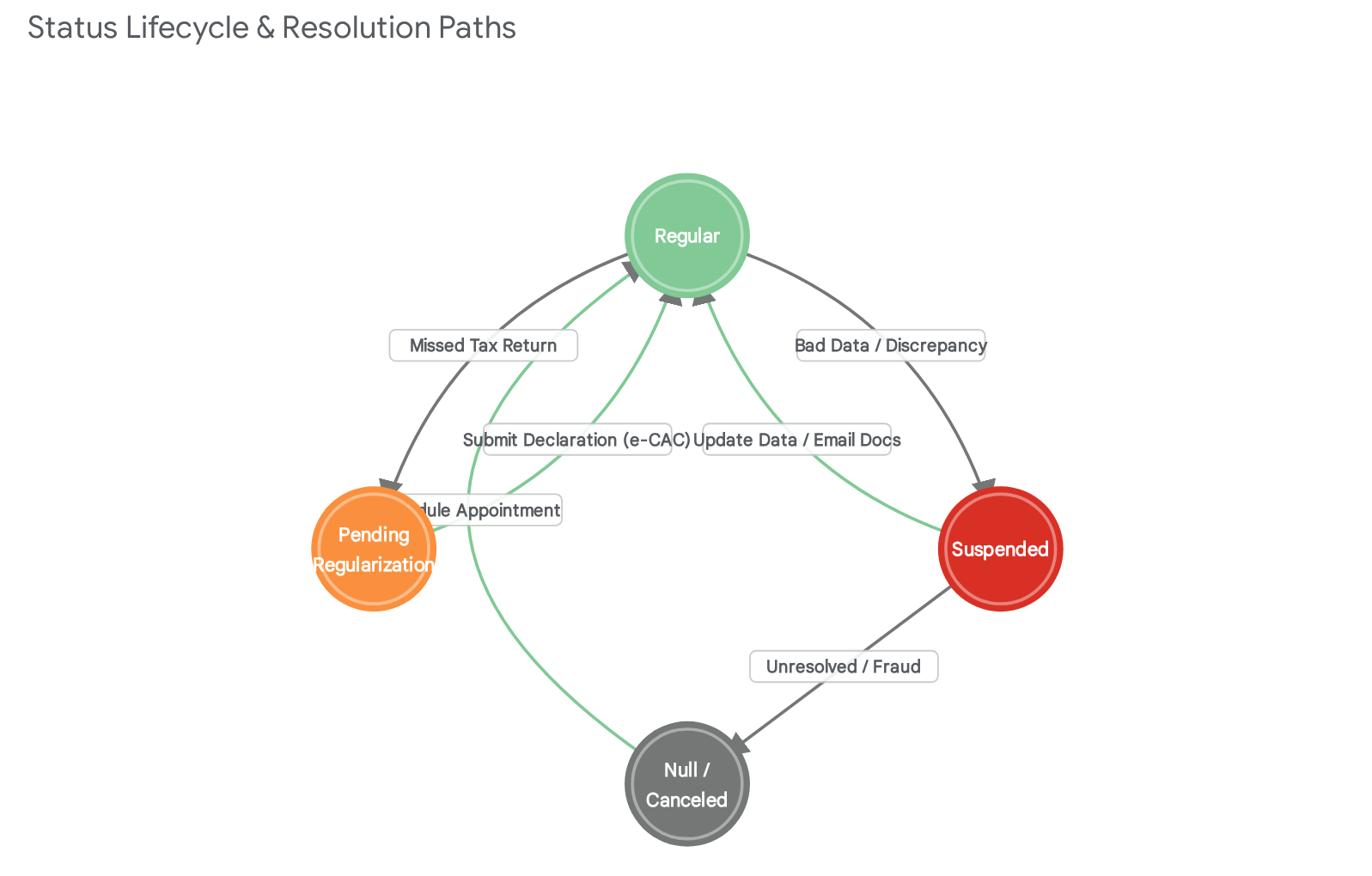

12.2 “Pendente de Regularização” (Pending Regularization)

This status is the most common affliction for foreigners who own property or have held a CPF for several years.

- The Trigger: It indicates that the system expected an Income Tax Return (Declaração de Imposto de Renda) for a specific year, and none was received.

- The Paradox: Foreigners often exclaim, “But I don’t live in Brazil and I have zero Brazilian income!” The system, however, operates on triggers. If a foreigner is listed as the owner of a property in a registry, or if they once had a bank account and moved money, the system may flag them as obligors.

- The Legacy of DAIE: Historically, foreigners had to file an “Annual Declaration of Exemption” (DAIE). Although this form was abolished years ago, the legacy data sometimes triggers “ghost” obligations.

- The Resolution: The fix involves a two-step diagnostic. First, identifying the specific tax year causing the block via the e-CAC portal (which is difficult to access without a high-level Gov.br account). Second, filing a “Regularization Declaration”—essentially a late tax return (often with zero value) to clear the missing year. Our legal team performs this diagnostic routinely, often clearing the status within days.

12.3 “Suspenso” (Suspended)

This status differs from “Pending” as it relates to registration data, not tax behavior.

- The Trigger: Incomplete or inconsistent data. It is frequently seen in foreigners who obtained CPFs prior to 2010. Common causes include a missing mother’s name, a mismatch in the date of birth between the CPF and the Electoral database (TSE), or failure to vote (for naturalized Brazilians).

- The Dead Loop: Attempting to fix this online often leads to a “Catch-22.” The online regularization form asks for the Voter ID. The foreigner leaves it blank (as they don’t have one). The system rejects the form because the underlying suspended record thinks they should have one (due to a data error).

- The Resolution: This cannot be fixed via the automated form. It requires a manual intervention—a formal administrative process where an attorney submits proof of non-citizenship and passport data to force a manual update of the registry.

12.4 “Nulo” (Null)

This is a rare and severe status indicating fraud detection. It usually implies that the Receita Federal has found multiple CPFs assigned to the same person or that the documents used to generate the CPF were deemed counterfeit. Resolving a “Null” status requires a formal administrative defense and, in many cases, the issuance of a completely new number after the fraud investigation is concluded.

If you already have a CPF but it is unusable (“Pendente”, “Suspenso”, or other irregular status), the fastest path is usually not guesswork—it’s a structured diagnosis and the correct regularization filing.

Oliveira Lawyers helps foreign citizens troubleshoot CPF issues by:

- identifying what is actually triggering the status issue,

- preparing the correct supporting documents and filings, and

- guiding the administrative steps needed to restore usability for banking, real estate, and services.

CPF “Pendente” or “Suspenso”?

We Can Help You Regularize and Move Forward.

#1 Contact us for a free quote, or

#2 Schedule a Consultation now.

13. CPF: The Practical Way to Get Yours Now

In 2026, the Brazilian CPF is more than a card; it is a digital credential that requires precise setup. While the Consular route remains a valid, low-cost option for those with ample time and patience, the risks of “Voter ID” glitches, data entry errors by consular staff, and the sheer unpredictability of appointment scheduling make it a fragile path for serious investors.

13.1 The Oliveira Lawyers Advantage

Our Remote Assistance Service is designed to neutralize these variables. By acting as your legal proxy, we ensure:

- Data Integrity: We validate your “filiation” data against Brazilian norms to prevent future banking blocks.

- Speed: We bypass consular wait times, filing directly with the processing units.

- Compliance: We register you with the correct “Non-Resident” tax flags.

- Support: We resolve any system “glitches” (like the Voter ID trap) in real-time.

- Service Fee: USD 325.00

- Turnaround: 3–7 Business Days

For the real estate investor, the expatriate, or the global business person, the CPF is the first step. Ensure it is taken correctly.

13.2 Document Checklist for Remote Processing

To expedite your application via our service, please prepare the following digital assets:

| Document | Requirement | Notes |

|---|---|---|

| Passport | High-resolution PDF scan. | Must be valid (not expired). Bio-page only. |

| Birth Certificate | Clear scan (PDF/JPG). | Crucial: Must clearly show Mother’s and Father’s full names. |

| Proof of Residence | Utility bill or bank statement. | Must be from your home country (not Brazil) to prove Non-Residency. |

| Selfie | High-quality photo. | You holding your passport open next to your face (for identity verification). |

Watch Our Video “How to Obtain the Brazilian Tax ID Known as CPF”. If you still have questions after watching our video, enter your questions in the comments area of our video. Questions entered as a comment will be answered by our licensed Brazilian attorneys. Check the comment section to have it answered by one of our licensed Brazilian attorneys

Questions entered as a comment will be answered by our licensed Brazilian attorneys. Check our YouTube channel for other videos addressing the purchase of real estate properties in Brazil for other videos addressing the purchase of real estate properties in Brazil

CPF Frequently Asked Questions (FAQ’s) for Foreign Citizens

1) What is a CPF?

A CPF (Cadastro de Pessoas Físicas) is Brazil’s federal taxpayer ID number for individuals. It’s managed by Brazil’s Federal Revenue Service (Receita Federal) and is used as a primary identifier in many everyday transactions in Brazil.

2) What is a CPF used for in real life?

Foreigners most commonly need a CPF to:

- buy/sell real estate, sign deeds, and complete notary/registry steps,

- open bank accounts and use many financial services,

- activate phone plans,

- shop online (Brazilian websites often require it), and

- sign up for utilities, schools, and other service providers that “expect” a CPF field.

3) Do I need a CPF if I’m only visiting Brazil as a tourist?

Brazil does not require a CPF just to enter or travel as a tourist. In practice, though, many private companies build their checkout or sign-up systems around CPF, which can create friction without one (especially online purchases and subscriptions).

4) Does a CPF give me residency, permission to work, or make me a tax resident?

No. A CPF is an identification number. It is not a visa, does not grant residency, and does not authorize work in Brazil.

Also, simply having a CPF does not automatically make you a Brazilian tax resident. Tax residency and tax filing obligations depend on your immigration/residency situation, time in Brazil, and income sources (Brazilian-source vs foreign-source income).

5) Is a CPF required to buy or sell real estate in Brazil?

In most real estate transactions, yes. A CPF is commonly required to execute contracts and complete notary and registry steps. If you are buying property in Brazil, getting a CPF is usually one of the first “unlock” steps.

6) Is a CPF enough to open a bank account or use Pix?

A CPF is typically necessary, but it’s usually not sufficient by itself. Many banks (including digital banks) also ask for additional documents such as proof of address and a Brazilian immigration ID/status document, depending on the institution’s rules and risk checks.

7) Do I need a CPF to get a Brazilian SIM card or phone plan?

Often, yes. Many travelers and expats report that carriers request a CPF to activate a SIM or set up a plan, although some tourist-focused SIM/eSIM options may work without one. The reality varies by carrier, city, and how/where you purchase.

8) Do I need a CPF for online shopping, delivery apps, and Brazilian websites?

Very often, yes. A lot of Brazilian platforms require CPF to create an account or complete checkout, and sometimes they require CPF information to match the payment method (for example, certain marketplaces).

9) Can foreigners get a CPF even if they are not residents of Brazil?

Yes. Brazil allows CPF registration for Brazilian and foreign citizens, including residents and non-residents.

10) Can I apply for a CPF before I arrive in Brazil?

Yes. If you are outside Brazil, you can apply through Brazil’s consular network (consulate/embassy responsible for your jurisdiction).

11) I live outside Brazil. What is the correct way to apply in 2026?

For foreign citizens residing abroad, the Brazilian government’s guidance is to apply in person at a Brazilian consulate/embassy (a post of the Brazilian consular network). Many posts use the e-Consular system for scheduling.

12) Can a foreigner apply online from abroad instead of going to a consulate?

Not fully. You may be asked to complete the CPF form online, but foreigners residing abroad are directed to apply in person at a Brazilian consular post. (The email-based path is generally aimed at Brazilians abroad, not foreign citizens abroad.)

13) I’m already in Brazil. How do I apply for a CPF?

If you are in Brazil, CPF applications can typically be initiated online and/or handled through Receita Federal channels, partner service points, or the partner network listed by the government (depending on your case and location).

14) Where can I apply in Brazil, and how much does it cost?

Government guidance indicates:

- CPF registration is free when done via official channels, except when done at certain partner/conveniada units, which currently charge a fee (listed as R$ 7,00 on gov.br).

- In-person options in Brazil commonly include Cartório de Registro Civil, Banco do Brasil, Caixa Econômica Federal, and Correios, plus Receita Federal service points depending on the request.

15) What documents do foreigners usually need for a CPF application?

Generally, you should expect to provide:

- an official photo ID, and

- a birth certificate or marriage certificate (or equivalent) if the photo ID does not clearly show nationality, parentage (filiação), and date of birth.

Additional documents may be requested depending on the case and channel.

16) Which identity documents are accepted for foreigners?

Government guidance (as reflected in Receita Federal rules) indicates different acceptable IDs depending on whether you are resident abroad/in transit vs resident in Brazil. Examples include:

- Residents abroad or in transit: passport; CRNM (or older CIE/RNE); and certain Mercosur IDs admitted under international agreements (subject to the applicable rule timeline).

- Residents in Brazil: CRNM (or older CIE/RNE); CRNM protocol; refugee-related provisional documents/protocols; consular registration certificate with photo; and certain Mercosur IDs (subject to the applicable rule timeline).

17) Do I need a Brazilian address to get a CPF?

Not necessarily. CPF registration is available for non-residents, and the application form includes “country of residence” style fields. You do, however, need to provide an address in the application, and the most practical choice depends on your situation (living abroad, temporary stay, moving soon, etc.).

18) Why does the CPF form ask for parents’ names (mother’s name) and other personal details?

Brazil commonly uses filiação (parents’ names) as part of identity matching. If your photo ID does not show nationality, parentage, and date of birth, the government may require a birth certificate or marriage certificate (or equivalent) to complete identification.

19) Can I obtain a CPF for my child (minor)?

Yes. Government guidance specifically covers CPF requests for minors, including what a parent/guardian must present and how requirements differ for:

- children under 16, and

- ages 16–17.

20) Can I authorize a representative or lawyer to apply for me?

Sometimes. Certain CPF-related requests (especially follow-ups or recovery in Brazil) may be handled by a representative with proper documentation (commonly a power of attorney), but some initial inscription pathways can still require personal appearance, especially when applying abroad through the consular network.

21) How long does it take to get a CPF?

There is no universal guaranteed timeline. Processing speed depends on where you apply (consulate vs Brazil, channel used, document completeness, local backlogs). Some official pages list timing as “not yet estimated,” so planning ahead is wise.

22) Do I get a physical CPF card? How do I prove my CPF number?

A CPF is primarily a number. In most situations, you use a digital or printed proof (often called a “cartão”/comprovante of CPF inscription), not a separate plastic ID card.

23) How do I check my CPF status, and what does the “Comprovante de Situação Cadastral” show?

You can check CPF status using Receita Federal’s public CPF status page. The generated proof is limited to your registration status and does not provide economic/financial/fiscal information about you.

24) What are the possible CPF statuses, and what do they mean?

Common CPF status labels include:

- Regular: no registration issues found.

- Suspensa: registration data is incomplete or incorrect.

- Pendente de regularização: typically indicates missing required income tax filings (DIRPF) for past years, if you were obligated to file.

- Cancelada / Nula / Titular falecido: other administrative statuses that can arise due to duplication, fraud, or recorded death.

25) What if my CPF is “Suspensa”?

“Suspensa” generally means your CPF record needs correction or completion. The government provides CPF update/regularization paths (some online, some in-person). If submitting by email (where available), you may be asked to provide a photo of yourself holding your ID next to your face for identity confirmation.

26) What if my CPF is “Pendente de Regularização”?

This status commonly points to missing income tax returns (DIRPF) when a person was required to file. Regularization typically involves submitting the missing returns (even late), or correcting the situation if the status was applied in error.

27) I forgot my CPF number. How can I recover it?

If you’ve lost your CPF number, recovery often must be handled in Brazil through Receita Federal. Many consular posts state they cannot resolve CPF number recovery due to tax data secrecy, and they may direct you to handle it in Brazil (potentially via a representative with a power of attorney).

28) Does CPF expire? What is the annual “recadastramento” requirement for foreigners abroad?

A CPF number does not “expire” like a visa, but your CPF can become irregular/suspended if requirements are not met.

As of January 13, 2025, consular guidance indicates that foreign nationals aged 16+ who have a CPF and a registered address outside Brazil must complete an annual recadastramento (registration confirmation) through the Receita Federal app.

29) Is it safe to share my CPF? How can I protect myself from misuse?

Treat your CPF like a sensitive identifier. Many Brazilian companies ask for it, but you should still share it only when it’s genuinely necessary and with trusted counterparties.

Brazil also offers an official “Protect My CPF” service that helps prevent unwanted inclusion of your CPF in company registrations, and it uses gov.br account access levels.

30) Can Oliveira Lawyers help me obtain or regularize a CPF?

Yes. We regularly help foreign clients obtain a CPF and keep the record consistent (which matters later for banks, real estate closings, and apps). Depending on where you are located, we can:

- confirm the best application path (Brazil vs consulate),

- prepare/review the required forms and supporting documents,

- help you avoid common rejections caused by mismatched names, missing filiação details, or inconsistent addresses, and

- assist with CPF updates/regularization when a status issue comes up.

31) Where can I find the original source of information from the Brazilian government on the CPF tax ID?

You can take a look at the normative instruction issued by the Brazilian Revenue Service governing the CPF Tax ID number. The IN RFB n° 1548/2015 can be accessed here .

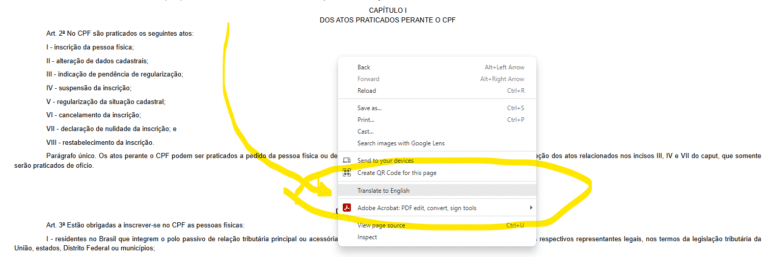

Wait! Did you forget I don’t speak Portuguese? Not really! You can simply right-click on this page (Chrome only) and choose “Translate into English.” Chrome does quite a good job, and you will be able to learn about the CPF directly from the horse’s mouth!

32) How can I check if my CPF number remains active?

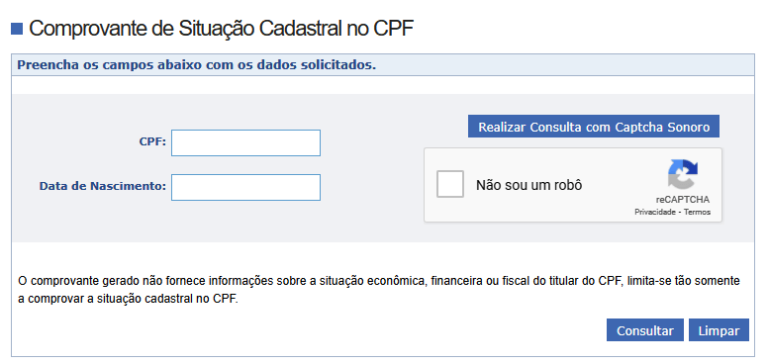

The Brazilian Tax Revenue offers a CPF checker application so you can check the status of your CPF number: https://servicos.receita.fazenda.gov.br/servicos/cpf/consultasituacao/consultapublica.asp

The CPF number should be entered in the first box, while the CPF’s holder’s Date of Birth should be entered in the second one. Note that the DOB format in Brazil is: DD/MM/YYYY.

Feeling Grateful for this Guide? Share It With Others!

Did you enjoy our guide? Was it helpful to you? Great! Pass the information around so other people like you can have access to it.

Member of an expat group? Share it there. Editor on Wikipedia? Share it there.

Know a friend or a friend of a friend going to Brazil? Let them know the URL by using the sharing button below!:

https://oliveiralawyers.com/services/real-estate/acquisition/obtain-your-cpf-tax/