Attorney Luciano Oliveira interviews Florianopolis-based realtor James Rocks Luciano Oliveira Read more →

Collecting Services in Brazil

When a client fails to pay for goods or services provided, you need to find a collection attorney or collection law firm in Brazil. Our collections attorneys come into play when Brazilian customers or businesses fail to pay you as agreed. An unpaid bill can wreak havoc on your balance sheets.

The services of a qualified collections lawyer can help bring your business’ cash flow back to order. We understand that your business relies on a steady and reliable income, and we will act quickly and professionally to recover the unpaid debts. There is no reason anyone should get away with not paying for the products or services you have given them. We intend to make sure they will not. That way, your business can continue as normal.

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us to get a free quote, or

#2 Schedule a Consultation now.

Debt collection in Brazil refers to the process of recovering outstanding debt from individuals or companies that have failed to pay what they owe. This process involves various steps, from pre-litigation efforts, such as contacting the debtor directly or through a debt collection agency, to legal action, such as filing a lawsuit and seeking enforcement of a court judgment.

The Brazilian legal system provides specific regulations and procedures for debt collection, and it is important for foreign companies to have a good understanding of these in order to be successful in collecting debt in Brazil.

Understanding the process for collecting debt in Brazil is crucial for foreign companies for several reasons:

By understanding the process of collecting debt in Brazil, foreign companies can increase their chances of success, reduce the risk of potential legal and reputational problems, and ensure a positive outcome for their business.

Our work with new clients always starts with a consultation over Zoom. This initial consultation helps us understand the dynamic between you and the debtor as well as coming up with the best collection strategy. Our consultation cost is applied as a credit in full if you decide to hire our services.

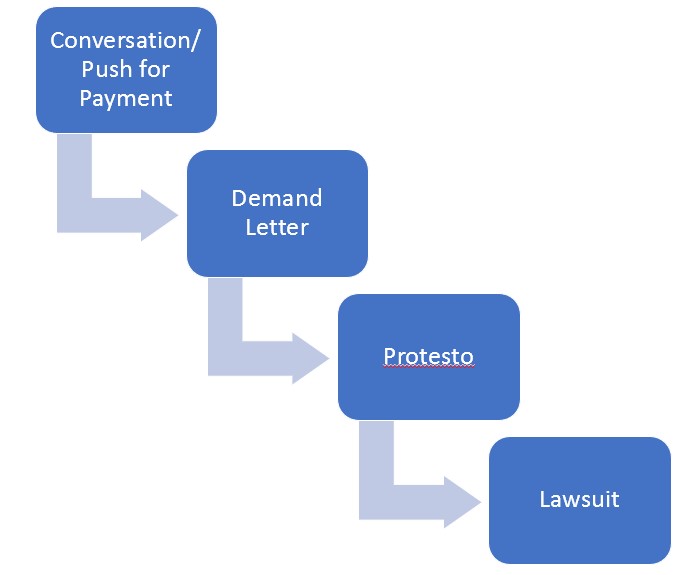

After our initial consultation with the client, we will call the debtor’s representative directly. A frank and straight to the point conversation may be enough to understand how much the debtor can pay per month and let him know that us – as licensed attorneys – are anxious to sue them IF they do not agree to a repayment plan. You would be surprised with how many debtors we are able to persuade through a direct conversation instead of threats and legalese stuff.

If the debtor agrees with repayment, we make them sign a binding agreement to repay your debt. This binding agreement has two main advantages: 1) it spells out how the obligation will be satisfied, avoiding confusion and excuses the debtor could raise otherwise, and 2) Making the debt easier to be collected through a collection lawsuit in case the debtor doesn’t honor the repayment agreement.

If the debtor does not take our call or does not agree to sign a repayment agreement, we will send them a demand letter. A demand letter gives formal notice of your intention to sue the debtor in case of non payment. Some of the debtors will capitulate at this stage and agree to sign a repayment agreement.

Protesto is a legal device we use to give notice of the debt. By means of Protesto, the debtor will have an entry to their credit profile stating the existance of an unpaid debt. This causes serious problems for the debtor such as loss of credit lines and ability to buy without full upfront payment.

This is another powerful tool we have to make debtors quickly pay their debts.

After the alternatives have been exausted, we will move swiftly to sue the debtor. A lawsuit may take time and cost you money, but it will get your money back in cases of debtors who are still viable financially.

Another big advantage of suing a debtor in Brazil is to send a clear message to other vendors and suppliers in your market. As you probably know, this is a small world. Leting a bad debtor go scott-free may convey to others that they do not need to worry about not paying you!

Cost for this service is based on the complexity of your case. Potential fee structure can be discussed during your initial consultation with our firm.

Questions about our collection worklflow and how we can address specific challenges in your case can be answered during a consultation with us. Our consultation cost is applied as a credit in full if you decide to hire our services.

#1 Sao Paulo, Brazil

#2 Rio de Janeiro, Brazil

#3 Dallas, Texas

#4 El Segundo, California

Our Brazilian collection attorneys believe in taking every step possible to get what you are owed. There are a variety of collections practices that we are knowledgeable in and will use depending on your circumstances. Options for your collection efforts in Brazil include:

We will review your case to determine the best course to take, whatever your unique situation may be. Since collections in Brazil can be different than collections in other countries, it is important that an experienced law firm is chosen. Our Brazilian collections attorneys understand the collections law in Brazil. Their experience assures that the necessary steps will be taken in order to collect successfully.

Our collections attorneys and debt collectors can collect on just about anything owed, including:

The Brazilian collections attorneys at our firm are accomplished negotiators, and develop strategies to resolve debt disputes in a fair and constructive manner. Recognized for our ability to initiate alternate dispute resolution methods, our firm is also a strong performer in the courtroom if litigation is deemed to be necessary.

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us to get a free quote, or

#2 Schedule a Consultation now.

When you are owed money in Brazil, fast action is important. The debtor may not have the available assets in the future, so we act quickly to recover what you are owed. Aggressive action is also important, and our expert Brazilian collections attorneys will take every step available to get your funds, while maintaining the utmost professionalism. We will make demands, file lawsuits, get judgments, and take action to collect on those judgments in Brazil.

Our debt collectors in Brazil will work hard to get results. At the same time, we know that debt collection requires a professional, measured approach, and we will not compromise your business’s reputation in Brazil. At our firm, you’ll find Brazilian collections attorneys you can absolutely trust.

Asset Searches

Not surprisingly some debtors will hide their assets in Brazil and tell you they are unable to honor their obligations. Our collection agency employs licensed private investigators to provide professional asset searches to clients with credits in Brazil.

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us to get a free quote, or

#2 Schedule a Consultation now.

In Brazil, the statute of limitations sets the maximum period of time within which legal action can be taken to collect a debt. This time period depends on the type of debt, and for most types of debt will range from 1 to 5 years. The time-bar is the deadline for taking legal action, after which the right to collect the debt is lost.

It is important for foreign companies to be aware of the statutes of limitations and time-bars for debt collection in Brazil, as failing to act within these deadlines can result in the loss of the right to collect the debt. In order to ensure that they can take action within the appropriate time frame, foreign companies need to keep accurate records of debt owed and monitor the status of their debts closely.

It is also worth noting that the statute of limitations may be interrupted or suspended under certain circumstances, such as the recognition of a debt in court, the submission of a payment proposal, or the negotiation of a settlement agreement. Foreign companies need to be aware of these interruptions and suspensions and plan their debt collection efforts accordingly.

Do not take these rules literally, as they must be interpreted by a licensed Brazilian attorney for a correct understanding of your situation. Article 206 of the Brazilian Civil Code prescribes:

§ 1 In one year:

I – The claim of the hosts or providers of food intended for consumption in the establishment itself, for the payment of the accommodation or food;

II – The claim of the insured against the insurer, or vice versa, counting the period:

a) for the insured, in the case of liability insurance, from the date on which he is cited to respond to the compensation action brought by the third party who was harmed, or from the date that the latter is compensated, with the consent of the insurer;

b) as for other insurance, from knowledge of the fact that generates the claim;

III – The claim of notaries, justice assistants, judicial servants, arbitrators, and experts, for the perception of fees, costs, and fees;

IV – The claim against experts for the evaluation of the assets that entered into the formation of the capital of an anonymous society, counted from the publication of the minutes of the assembly that approves the report;

V – The claim of unpaid creditors against the partners or shareholders and liquidators, counting the period from the publication of the minutes of the winding-up of the company.

§ 2 In two years,

the claim for alimony, from the date on which they become due.

§ 3 In three years:

I – The claim relating to rent of urban or rural buildings;

II – The claim to receive overdue payments of temporary or life-long rent;

III – The claim to receive interest, dividends or any other accessory payments, payable, in periods not exceeding one year, with or without capitalization;

IV – The claim for reimbursement of unjust enrichment;

V – The claim for civil damages;

VI – The claim for the restitution of profits or dividends received in bad faith, counting from the date when the distribution was decided;

VII – The claim against the following persons for violation of the law or the statute, counting the period:

a) for the founders, from the publication of the constitutive acts of the anonymous society;

b) for administrators, or auditors, from the presentation of the balance sheet to the partners regarding the fiscal year in which the violation was committed, or from the meeting or general assembly that should be aware of it;

c) for liquidators, from the first semiannual assembly following the violation;

VIII – The claim to receive payment of a credit instrument, from the due date, subject to the provisions of special legislation;

IX – The claim of the co-owner against the insurer, and that of the third party who was harmed, in the case of compulsory liability insurance.

§ 4th In four years,

the claim relating to guardianship, from the date of approval of the accounts.

§ 5th In five years:

I – The claim for collection of liquid debts contained in public or private instruments;

II – The claim of liberal professionals in general, judicial attorneys, curators and teachers for their fees, counting from the conclusion of the services, termination of their contracts or mandate;

III – The winner’s claim to receive from the loser what he spent in court.

[email protected]

(214) 432-8100

+55-21-2018-1225

#1 Contact us to get a free quote, or

#2 Schedule a Consultation now.

The statute of limitations for debt collection in Brazil varies depending on the type of debt. For example, the statute of limitations for collecting insurance proceeds is one year, while the statute of limitations for collecting debts from a promissory note is three years.

The debt collection process in Brazil typically starts with a demand letter or a phone call to the debtor. If the debt is not paid, the creditor can file a lawsuit in court. The court will then rule on the case and, if the debt is found to be owed, a payment plan can be established.

Yes, debt collection agencies can be used in Brazil. However, they must abide by the rules and regulations set forth by the Central Bank of Brazil. Additionally, debt collection agencies usually do not know nor understand the requirements applicable to foreign creditors as the need for using apostilled and sworn translated documents.

Yes, wage garnishment can be used for debt collection in Brazil. However, there are limits on the amount that can be garnished, and the process must be done through a specific legal procedure at the court system.

Yes, debts can be discharged in bankruptcy in Brazil. However, certain debts, such as taxes and alimony payments, cannot be discharged in bankruptcy.

Unfortunately not. Debts resulting from transactions with foreign parties will almost always not meet the legal requirements of debt immediately enforceable in Brazil. As a result, foreign creditors will need to go through a process first to have the debt recognized by a court.

Yes, there are consumer protection laws in Brazil that pertain to debt collection. These laws aim to protect consumers from unfair debt collection practices and to ensure that debt collection agencies follow fair and ethical practices. The main source of law impacting debt collection in Brazil is the “Código do Consumidor”.

The “Código do Consumidor” (Consumer Code) is a Brazilian law that establishes rights and duties related to consumer relations. It was enacted in 1990 and it aims to protect the rights of consumers, ensuring fair practices in the marketplace and promoting free competition. The Consumer Code covers various aspects of consumer protection, including advertising, product quality, warranties, contracts, and debt collection.